Breaking Debt: Conquer big debt with little wins

Staring at a mountain of debt can be scary – especially when you’ve got multiple debt streams (student debt, credit card 1, credit card 2, car loan – the list goes on). Getting into that kind of debt can be as easy as not paying attention to your spending, but getting out of debt can require a plan and some powerful strategies.

The brain trust at the Kellogg School of Management (Northwestern University’s business and marketing experts) have detailed a study that shows an awesome plan for getting out of debt – by focusing on little wins, instead of jumping into paying down the areas you owe the most

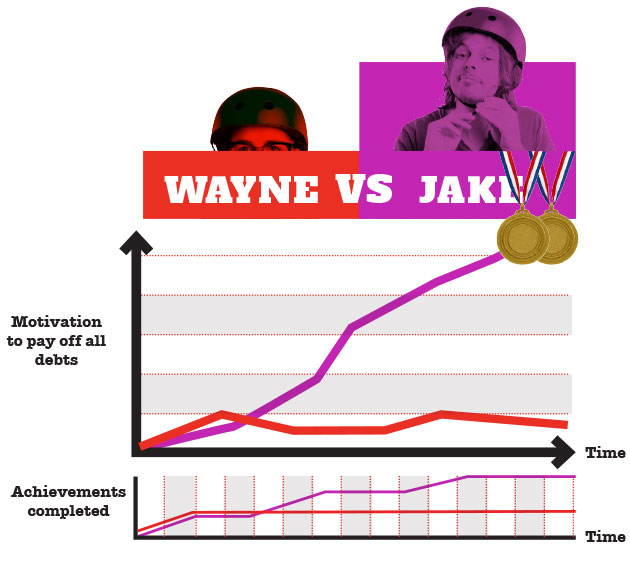

Basically, the more ‘wins’ you can get in a period amount of time will propel you to stay on track and achieve your goals of financial freedom

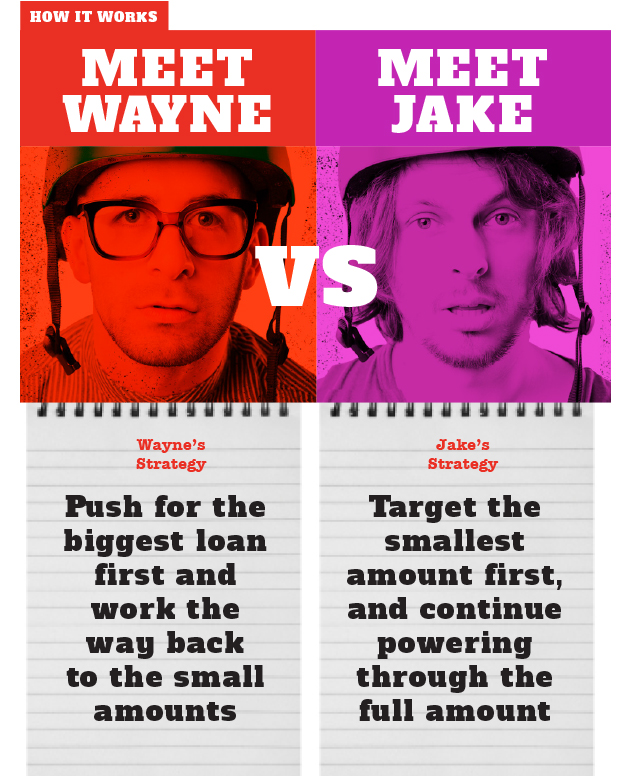

Here’s how it works:

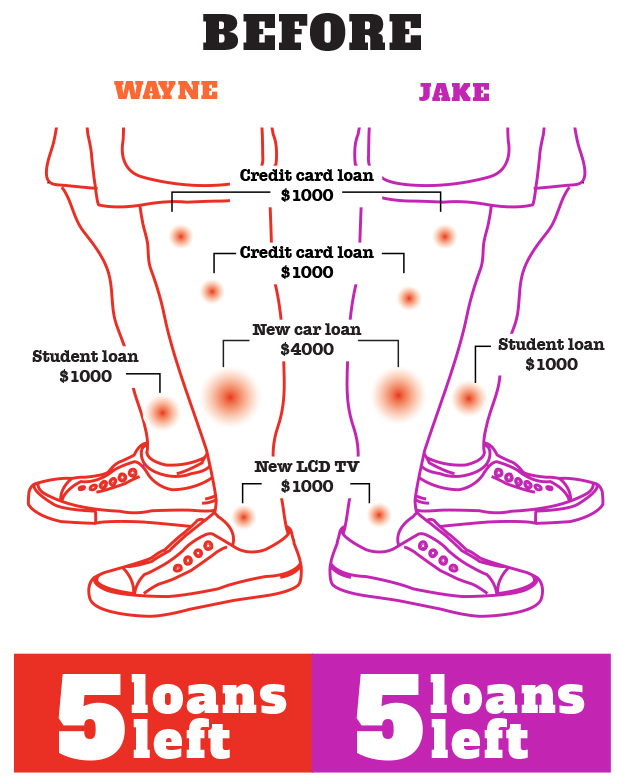

As of beginning of the year, Wayne and Jake are both sitting on the same number of loans and they both are owing $8,000 in total. For the sake of this study, lets assume all debt is at the same interest rate. Here are their strategies.

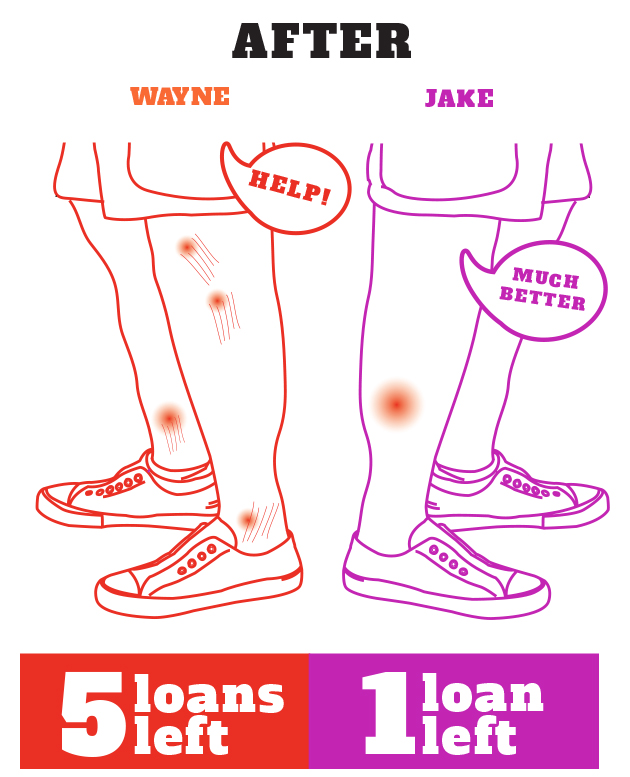

Over the course of a year, both Wayne and Jake have paid down their debt by $4000. Wayne paid off the **one **$4000 debt while Jake has knocked out all of the $1000 debts.

Who is the winner?

“So the question is, does that person who looks the same in every respect, except they’ve paid off three of their four debts versus one of their four debts – are they more likely to successfully exit the program?”

According to Kellogg, parties who hit more of their achievements are more motivated to stay on track, even if they have progressed through the same percentage of debt payments.

If you find yourself in a similar type of debt position, target your smallest amount first, and continue powering through the full amount – it could be the weapon you need to stay on track, and blast all of the debt, instead of just some of it.