You probably don’t feed your Tamagotchi or play with Pogs anymore, but you might still be going to the bank that you grew up with. (Why would you do that to yourself??) If you didn’t grow up with a big bank or aren’t currently tethered to one, high-five.

Canada’s adoption rate of financial technology is 8.2%, which is below the average global rate of 15.5%, and way below Hong Kong’s adoption rate of 29.1%. Which means that most of us are still stuck with our old banks/not exploring or taking advantage of our financial options. But that 8.2% is estimated to double this year, as more and more people become aware of FinTech (and how awesome it is). If you have a MogoAccount right now, you’re already one of these FinTech early adopters. ;)

Maslow's Hierarchy of Needs for the 21st Century

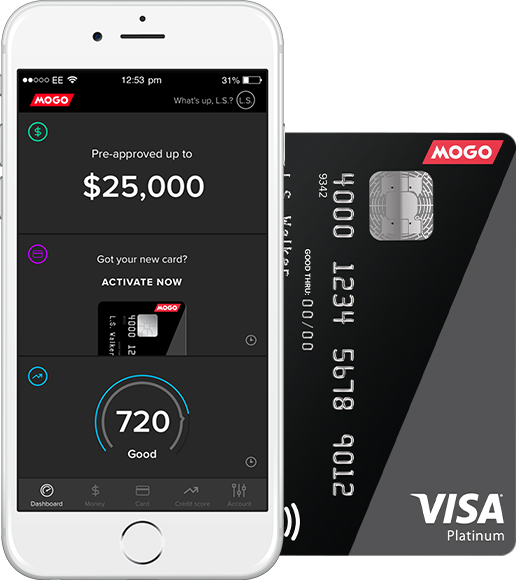

A huge reason why people are leaving their banks is because of the inefficient/inconvenient/crappy bank experience. Want to get stuff done on the go with your smartphone? Good luck. At Mogo, we’re all about creating an amazing digital experience and we’re always thinking about what we as consumers expect from one. Things like top security, an app that’s easy to use, you know, stuff like that.

Our focus is on building a fully digital experience with products that are simple and engaging to use. Most importantly, we are helping consumers make better decisions around their finances and ultimately, improve their financial health.

- Dave Feller, Mogo CEO

And oh hey, The Financial Brand agrees—check out their pyramid that describes what consumers are needing from a digital experience.

5. Make it safe and secure

All the data in your MogoAccount is encrypted and secure, plus we’re building Touch ID into the Mogo app so that you can unlock it with your fingerprint.

4. Make it easy to do

After a quick 3-minute signup, we’ll show you your credit decision (just in case you need some $$), your credit score (aka. your financial report card, paid for by us and provided by Equifax Canada), and put you on the list for the upcoming MogoCard. No hassle, no messing around with paperwork.

3. Make it faster than other ways of doing it

It takes just 3 minutes to sign up for a MogoAccount online and get a MogoMoney loan pre-approval decision. Not to mention you get funded as soon as the same or next day. Hey, it beats lining up at the bank.

2. Do for me. Anticipate my needs.

The app’s informative alerts proactively let you know what’s going on with your account and how much you’re spending so that you don’t have to always call in for every little thing. Cause that’s for banks.

1. Think for me.

Sign up for Mogo. We’ll do the rest.

What’s keeping you?

If Uber can make catching a ride a breeze, why can’t managing your finances be just as seamless and easy? (Okay, maybe finances are a little more complicated...) You’ve actually got options now, with better digital experiences and better products coming out every day. Go on, explore them.

Ready to treat your finances to a whole new experience? Sign up for a free MogoAccount in just 3 minutes to change your (financial) life.