Spend your money on what you love

Stop spending it on interest and fees

Spending money is fun when you’re spending it on the things that make you happy. We think that you should be making more of these fun transactions by reducing the amount you spend on unnecessary bank fees and interest charges caused from overspending.

The problem is that credit cards and debit cards aren’t effective tools for managing your spending money and their fees are built around making you pay for your mistakes.

Credit cards make it way too easy for you to spend more than you have. It starts with high approval amounts, typically thousands more than you really need. They incentivize you to spend more with rewards points, most of which convert into $10 of value for every $1000 spent on the card. Remember the card company is making up to $250 a year for the same $1000 balance accumulating interest. It’s easy to see who is making the most out of your money here and its not you. Debit cards are tied to your bank account which is typically a pretty busy account. The problem with trying to manage your spending money in your bank account is that you usually have scheduled bills and payments coming out. Trying to keep track of all the money travelling in and out makes it difficult to stay in control and when that happens, you get dinged with excessively high overdraft or NSF fees.

The easiest way to manage your spending money is on the Mogo Card.

Use your Mogo Card to manage your spending money

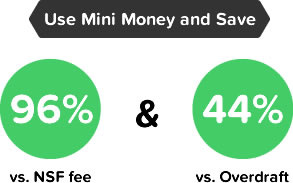

By separating your spending money onto your Mogo Card you’ll always know how much you have available to spend until you get paid. Plus you can track it with free text message balance updates on the go. It keeps you in control and won’t let you spend more than what you have so there’s no risk of getting into debt or being charged over the limit, overdraft or NSF fees. On top of that, card is free to use there’s no monthly fee, load fees or transaction fees and there’s no credit check to get a card.

Use your Bank Account for fixed bills and payments

**Use your bank account for fixed expenses like rent or mortgage, utilities and car payments. **Your bank account is best designed to handle regular and expected incoming and outgoing payments. Getting your spending money out of this account and onto a Mogo Card reduces the chances of overdraft or NSF fees. Plus, the monthly fee on your bank account is usually based on the number of transactions you make so you may be able to lower your monthly fee by as much as $10 with all your spending money moved to your Mogo Card.

**If you need a few hundred bucks to get by, try our short-term loan options. **Avoid adding more long-term debt to a credit card or paying over the limit fees. A simple application unlocks your Mogo Money account where you’ll have access to 2 different loan options depending on your needs.

In case of emergency, use your Credit Card

Canadians owe over $80 billion on our credit cards. Every Mogo Card comes with free reminder stickers to help you stay away from your credit cards. If you’re carrying a balance on a credit card you can start paying it down by decreasing your spending allowance on your Mogo Card. Remember we want you to spend more on the things you love, not never-ending interest payments.

As you can see, we think that credit and debit card’s have their individual purposes but it isn’t until you add the Mogo Card to the mix that staying in control and avoiding fees and interest becomes real.