Dating someone with debt: my partner has bad credit, now what?

My friends always ask for my financial fitness advice and it's often around stuff like when they should talk about finances with their partner or how do they tell their spouse about the credit card debt that funded their shoes and booze-filled 20s.

Here’s the thing...

Your credit report is your financial report card and your credit score is your grade. Together, they show if you've got your life together. Let's say you're in a relationship with someone and the two of you want to buy a house. If your credit rocks and theirs sucks, that might not bode well for your future together. And sure, you're probably not—and you shouldn't be—picking a partner based on their net worth, but it is important to be aligned with someone who has habits and goals that are on your level.

I’ve got my own set of advice, but I wanted to find out what people think about a partner’s credit score and if it's really a dealbreaker (or maker).

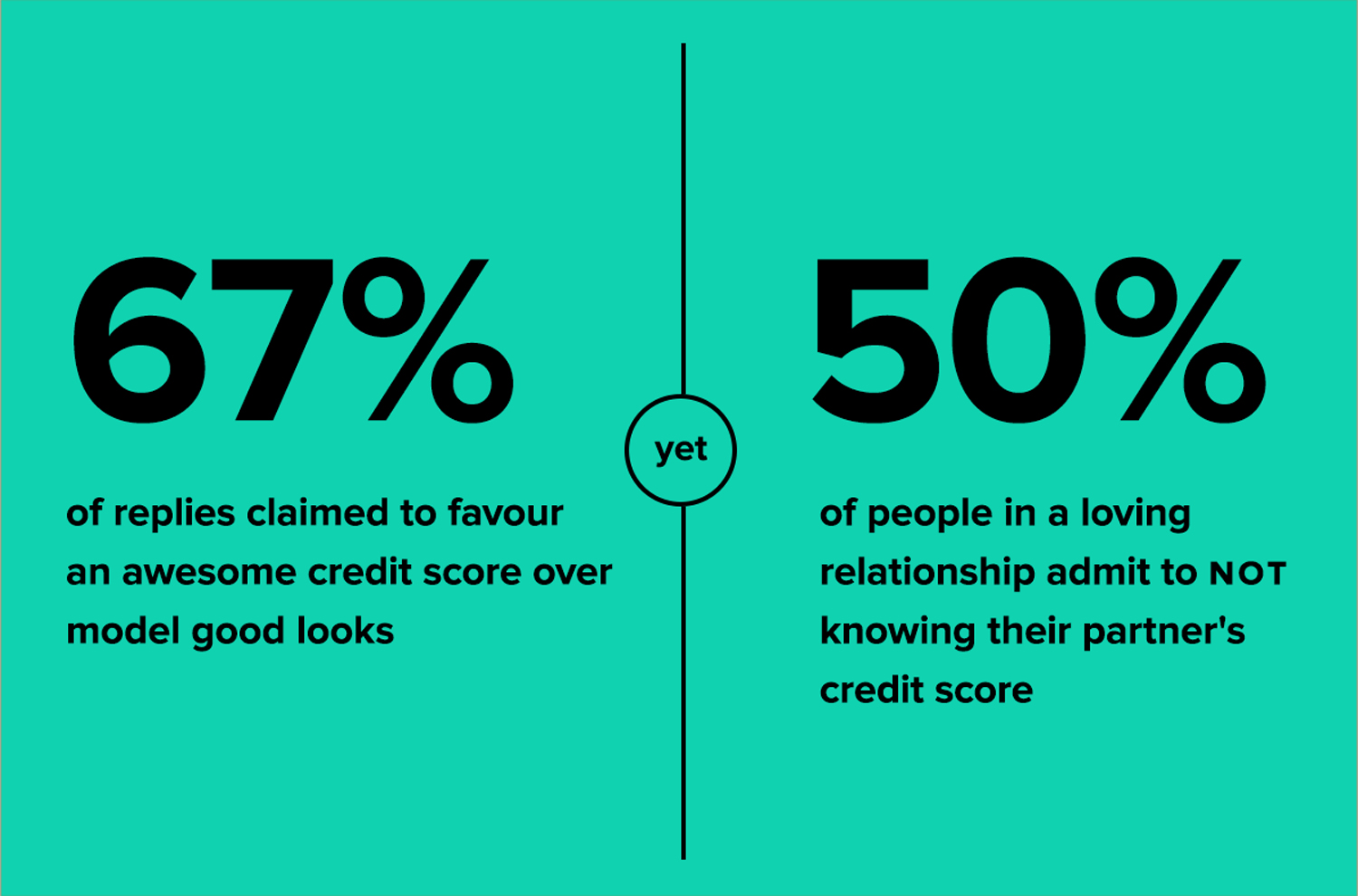

So… I ran this survey and found out the following:

So I asked: “When do you think it’s a good time to start having an idea of your spouse's credit situation?” Check out what people really thought:

40% of respondents think you should know your partner's credit score before you move in together

20% think you should know before buying a home

15% think you should know before getting married

2% think you should know before having sex

Suze Orman says that,

“”

Before you get involved in a relationship or anything, FICO [credit score] first, then sex.

Okay, that’s a little old-school and sex back then probably meant marriage and kids, but you definitely need to have an idea before you’re even close to looking at your Netflix-and-chill partner like a life partner.

Here’s why dating someone with bad credit might not be a great idea:

1. They’re probably not organized/messy.

2.Debt and finances can tear a relationship apart.

3. They may have issues with priorities; there is nothing wrong with being the life of the party but I always tell my pals that when it comes to choosing a partner, you need a mullet man/woman (business in the front, party in the back).

4. Their hotline will be blinging with private or blocked calls on the regular and that's just awkward—are they hiding something scandalous? Oh wait, it's just debt collectors.

5. They don’t respect money. They might ball out on credit to look good at the club but when an emergency comes up, they could be f*cked and potentially relying on you to clean up their mess. Not a hot look.

6. When you want to take things next level and buy something together like a house or a car on credit, their low score could cost you by getting charged a much higher interest rate (or even getting declined).

What to do if you find out your SO's credit sucks

Well, it’s not a deal breaker:

87% of respondents said they would actively encourage their partner to fix it

2% would dump their partner

10% don’t care about that triflin’ nonsense

Tips on how to bring up the "credit talk" while dating

Before you have the talk, start looking for signs that indicate that your SO might not be on top of their credit.

Things such as: they're really disorganized, they're forgetful about dates and deadlines, they get a lot of phone calls that they don't answer in front of you, among others. If you notice these things, you should probably have the talk. But either way, you should definitely have it before you combine finances/get serious.

According to PlentyOfFish

(only one of the biggest dating sites ever), having this talk is a good time to find out some other things that are related: “Is this a one time expense, or an on-going issue? What are the steps being taken to pay it down? Once you get honest and help each other wherever you can, hopefully it won’t seem like an insurmountable issue.”

Talk about your own budget and credit score.

Show them that you have a positive relationship with money and talk about your own goals to encourage them to do the same. You could even make a game out of it and see who can increase their score faster.

Finding out your significant other has a low score is an opportunity to educate and become closer.

87% of survey respondents said they would actively encourage their partner to fix it and only 2% said it may be cause for breaking up. There's a lot of information out there; If they love you, they want to help.

It's not about the score… or maybe it is.

You want to connect with someone who can respect your financial values. A credit score is a great indicator. Think of it as a shortcut to understanding someone's values and everyday habits.

P.S. If you’re single and want to find a hot credit date, you can check out this site. LOL

Get on our newsletter list to be the first to know about all the cool stuff we’re doing this year!

Chantel Chapman is Mogo's Financial Fitness Coach. She teaches you how to be an adult, and is also the host of our Adulting 101 events. With over a decade’s experience as a mortgage broker, Chantel recognized a need for financial education with many of her first-time homebuyers, so she began creating custom content to help guide them. Chantel is the founder of Holler For Your Dollar, a consulting firm that jump-starts anyone who’s ready to dive into the world of Adulting or entrepreneurship. Her role at Mogo puts her skills to use creating and teaching digestible, yet educational financial literacy content geared to millennials and daring entrepreneurs.