Why you need a Spending Account

You have a chequing account, and probably a savings account...But what about a spending account?

Think about it this way:

Say you have all of your pay cheque going into your chequing account, and all your bills, savings and fixed costs are coming out of that account. And you’re using your debit card that’s linked to that account for your day-to-day spending. That’s a recipe for blowin’ your budget. So, we created a way for you to move your spending money into a separate account, keep things in check, and avoid overspending!

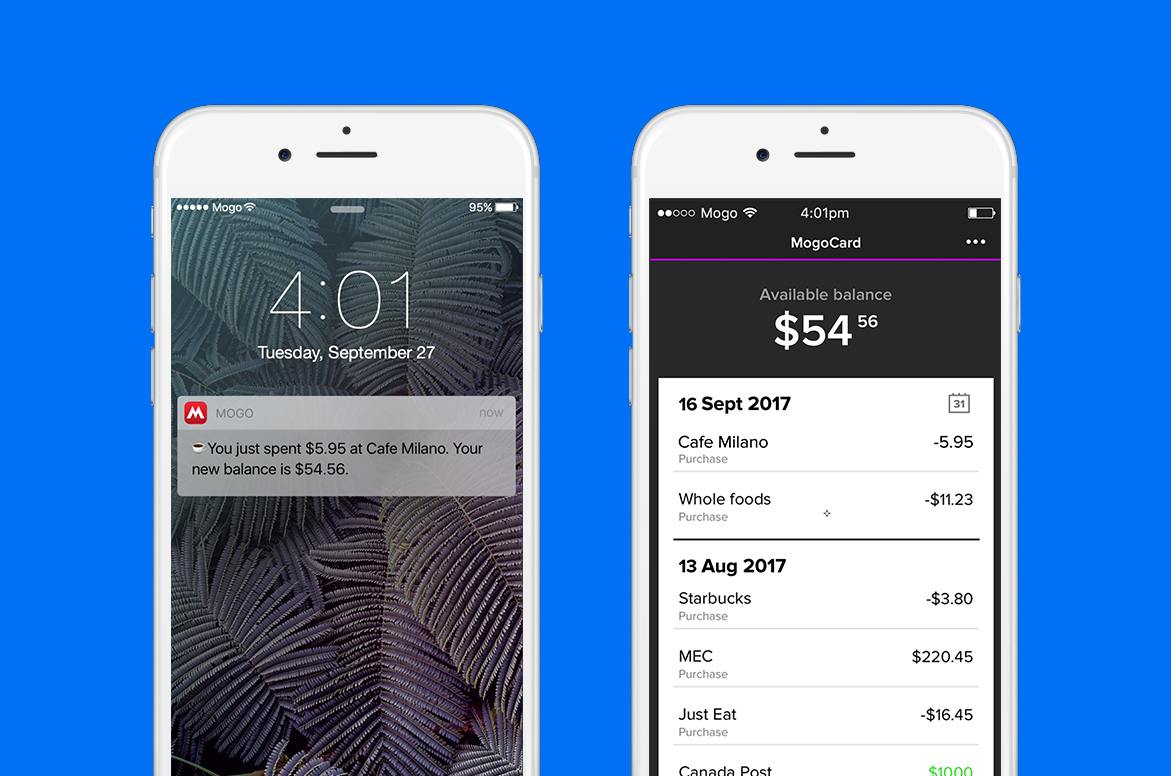

The Mogo Spending Account is designed to help you monitor and control your spending in a convenient and engaging way, with features like instant transaction alerts to your phone with each purchase and updated real-time balance. There are no monthly account fees and unlike a regular credit card, using the MogoCard means there is no risk of overdraft fees or interest charges.

We know what you’re thinking. You thought you were being smart by using your debit card rather than racking up credit card debt. It’s a good start! But the problem with using a debit card is that the money's coming out of your main bank account—which is where other stuff like your rent or mortgage payments also come out of.

“”

1/3 of Canadians overspend on day-to-day expenses

While we’re on the subject of credit cards... If you’re using your credit card for your everyday spending, and you’re like 56% of Canadians and carry a credit card balance every month, it’s time to get out of that revolving debt cycle. For a lot of us, credit cards are just too tempting and do a really good job of keeping us in debt since we can keep borrowing against them every time we pay them down.

Don't get distracted with points on credit cards, especially if you’re someone who isn’t so great at paying it off every month. What might give you ____ in perks could cost you $1000s in overspending. In fact, people spend 12-18% more when using credit cards.

“”

In Dec 2016, Canadians owed 569 billion in consumer debt—

and that’s not counting mortgages

Your Mogo Spending Account comes with a Mogo Platinum Visa® Card. Like a debit card, you're using your own money so that you're only spending what you have. Think of it as your dedicated Spending Account.

It's super easy—just move your spending money to the Spending Account. This way, you'll always know what's safe to spend and you won't use money meant for other important expenses.

Get your free Mogo Card and Mogo Spending Account (available on the IOS MogoApp)!

https://www.nerdwallet.com/blog/credit-cards/credit-cards-make-you-spend-more/

http://business.financialpost.com/personal-finance/debt/nearly-half-of-canadians-arent-taking-steps-to-meet-financial-goals-cibc-survey-finds