Crush your debt in 2 ways

Debt sucks, we agree. It’s the biggest financial stressor for most people, which is why paying down debt has been the top financial goal for Canadians 9 years in a row.

A recent survey shows that 57% of Canadians are carrying credit card debt, which proves that credit cards are a widespread problem and bad for your financial health. In fact, research has shown that people will spend as much as 100% more on a purchase with a credit card compared to spending their own money.

While there are a ton of different ways you can approach paying off debt, we’ve narrowed it down to two proven methods that you can start using to crush your debt. Before we get into the details, the prerequisite is that you are already taking control of your spending (for example, using the 50/30/20 rule), meaning that you aren’t going further into debt and you have a certain percentage of your income available for debt repayment.

Now let’s get into it.

First up, the snowball method

This method is all about small wins and staying motivated.

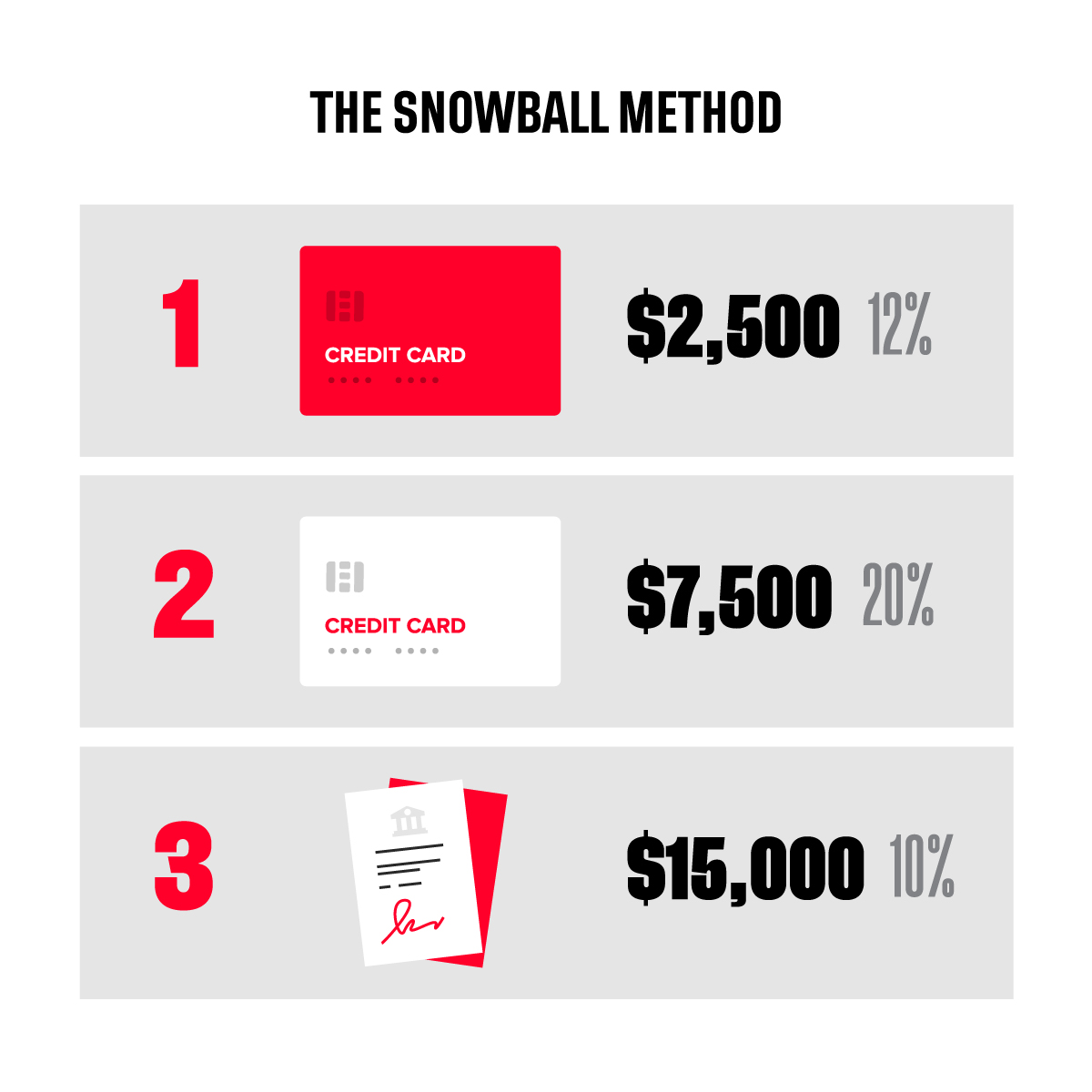

When snowballing, you pay the minimum monthly payment on all of your debts, then put any leftover money towards the debt with the smallest balance. Once that’s paid off, use that debt’s previous monthly payment and leftover money to pay off your next smallest debt. Repeat until you’re debt-free.

Research has shown that this method works best for keeping people motivated to pay off debt. Though getting rid of smaller debts first may not be the most economically effective approach, it does create a regular feeling of accomplishment.

Think of it like Super Mario: you don’t want to start off in Bowser’s Tower, right? You work your way up, collect stars, beat worlds, build confidence, and get yourself ready to take on the biggest challenge.

Example: Sam has a $2,500 debt on one credit card (12%), $7,500 on a second credit card (20%), and a $15,000 personal loan (10%). With the Snowball method, Sam would tackle the $2,500 credit card debt first and the personal loan last. Though it might make more economical sense to pay off the 20% credit card debt first, paying off the smaller debt first will accelerate the feeling of accomplishment and help motivate him to stick to his plan.

Next, the Avalanche method

The Avalanche method focuses on interest rate instead of balance.

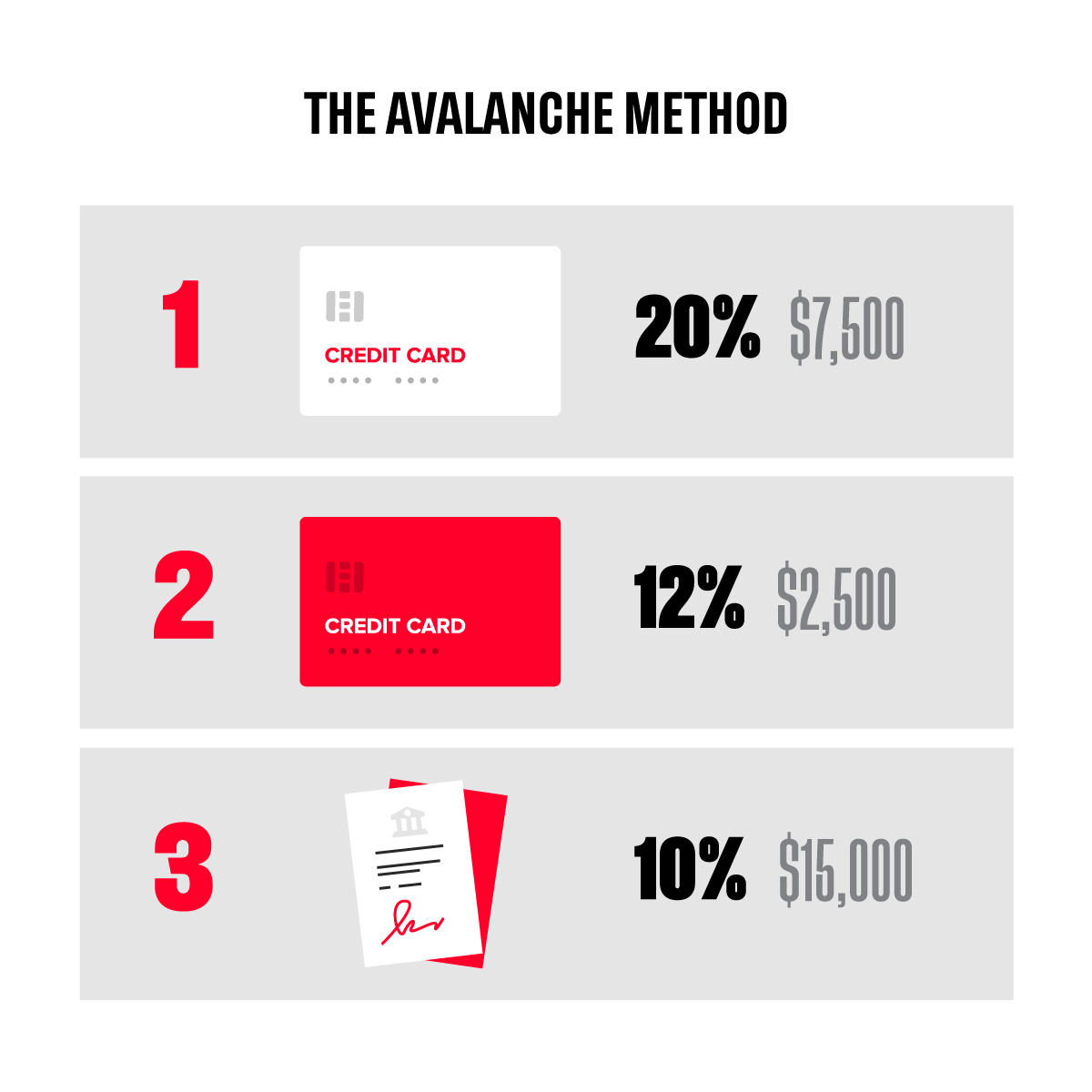

Like Snowballing, you still make the minimum payments on all your debts, but instead of using your leftover money on the debt with the smallest balance, you use it to pay off the debt with the highest interest rate. You then work your way through your debt until you get through the one with the lowest interest rate.

With Avalanching, you lower the balance on your highest-rate interest debt first, so if you’re able to stick to it, it’s the most cost-effective approach.

Example: Sam is in the same situation: $2,500 debt on one credit card (12%), $7,500 on a second credit card (20%), and a $15,000 personal loan (10%). With the Avalanche method, he would tackle the 20% credit card debt first and the personal loan last. If he’s able to stick to the plan, he will save hundreds, maybe even thousands, in comparison to the Snowball method.

Which one should you go with?

The Avalanche method is the solution that will save you the most money, and is our recommendation. However, if you feel you need to see some progress in order to stay motivated, then try the Snowball method. What it comes down to is finding a plan that works for you and sticking to it.

Even after you’re debt-free, this ability to stick to a plan will take your money a long, long way—believe us. Just remember: You're not broke, you're pre-rich. This is all just a part of the process.

Take your spending control to the next level

It's key to better control your spending, so you're not going further into debt and you have more income available to pay off your debt faster. MogoSpend, our free spending account that comes with a Visa* Platinum Prepaid Card, is designed to help you better control your spending with no interest or monthly fees.

| GET MOGOCARD NOW |

* Trademark of Visa International Service Association and used under licence by Peoples Trust Company. Mogo Visa Platinum Prepaid Card is issued by Peoples Trust Company pursuant to licence by Visa Int. and is subject to Terms and Conditions, visit mogo.ca for full details. Your MogoCard balance is not insured by the Canada Deposit Insurance Corporation (CDIC).