How to Save Money on Banking

Sorry, banks charge us money for having and using money? What?

I remember the day when it was, indeed, a bank fee that knocked my account into overdraft, for which I was then charged an overdraft fee. Thanks, capitalism.

Yep: banking itself can cost money. Sometimes, these fees pay for a specific service you can’t get elsewhere. Other times, they are essentially operating fees which you have to pay for the privilege of having a bank account. *light sarcasm*

It’s important to note that Mogo is not a bank. We’re a financial technology company that can help you save and spend wisely, but we don’t offer products like chequing accounts. So we can be pretty impartial when we say that some bank accounts seem like bad deals.

If you’re considering a new banking product, consider these tips to save money in the long run.

Set Your Banking Services Priorities

Oftentimes, paying for a bank account by way of an annual or monthly fee entitles you to services that you may personally find valuable.

Bigger banks with brick-and-mortar locations may provide, for example, on site tellers for withdrawals and deposits, and they also may offer financial advice. Generally, you’re entitled to book an appointment with an in-house financial advisor to get feedback and help develop a financial strategy that will help you meet your goals.

The kind of advice you get may be limited by the kind of products you use at that bank. If you only use a chequing account, the advisor may not feel comfortable giving investment advice. This varies.

By contrast, free accounts are often affiliated with “online banks” like Tangerine. These types of “online banks” have bank machines across Canada but very few brick-and-mortar shops. They also may not offer financial advice to free account holders. But they do have very robust online services underpinning their chequing and savings products.

So not all bank fees are downright bad. You have to decide what services you want, and if you’re willing to pay for them.

Check For One Time Fees

Banking fees probably aren’t going to bankrupt you. But they can nickel and dime you in a frustrating way. The first tier to look for are one time fees.

These are often associated with one time operations or services, like ordering a book of cheques, or even setting up an account in the first place. Fine, well—no one uses cheques anymore and you only have to set up an account one time. So what’s the biggy?

There’s more. You should also be looking for fees associated with occasional occurrences like sending funds via e-transfer or wire transfer. These are services many Canadians use every single day, and a “one time” fee associated with each transfer can start to pile up.

Scope Out Operational Fees

By operational fees, we’re referring to recurring fees like annual or monthly charges. These are generally the charges that, as we mentioned above, entitle you to certain services within your bank. Sometimes it’s financial advice, sometimes it’s a joint speciality household account.

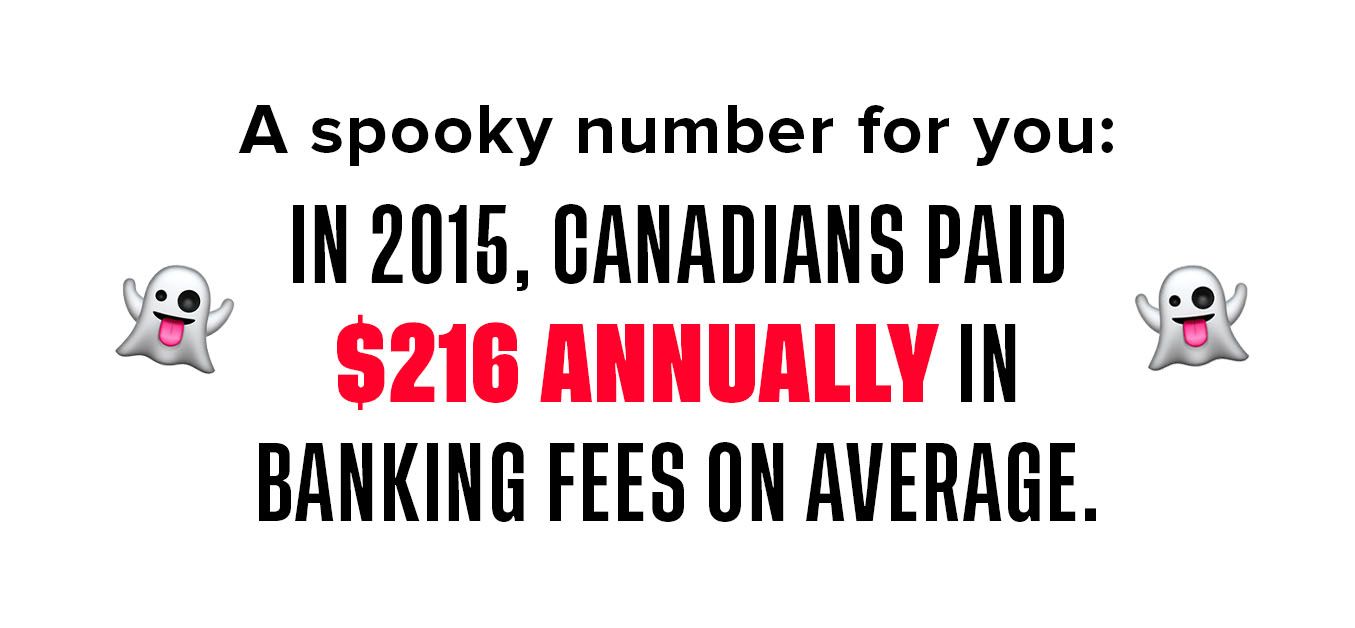

A spooky number for you: in 2015, Canadians paid $216 annually in banking fees on average. There’s no newer numbers on this from Statcan, unfortunately—but if talk of Canadian bank price gouging is representative, this number has likely climbed higher in the last six years.

$216? That’s not pennies. That’s over two hundred damn dollars per year, per person.

Be Wary of Penalty Fees

The penalty fees are real. Where to begin?

These fees might include, for example:

- Use of overdraft on a chequing account (which is normally tagged with credit card-level interest, btw)

- Dipping below a minimum balance requirement

- Insufficient funds penalties

- Withdrawing funds from a “locked” savings account with a set term

And these fees, again, aren’t just pennies. Tangerine’s No-Fee Chequing Account charges $5 if your account falls into overdraft over the end of the business day, and then 19.00% interest on the amount owing (check out the full fee schedule here).

When scoping out penalty fees, it’s important to consider your own banking habits and usage. How do you use your chequing account? Do you often go into overdraft? Does your budget require you to spend down to zero? Do you often forget when subscription or insurance fees are withdrawn from your account?

All of those factors should be considered when selecting a bank account. Because you may very easily wind up paying a big chunk of change to your bank if you aren’t careful.

Best Free Bank Accounts in Canada

There is a general consensus in the marketplace on which free bank accounts are the best.

The Government of Canada only recommends bigger “legacy” banks and no online banks, and none of them are truly free. You can peruse for more information on what the Government of Canada has to say on the topic here.

The folks over at MoneySense put together a handy list on their favourites, and they included:

- EQ Bank Savings Plus Account

- Tangerine No-Fee Chequing Account (but there are possible penalty fees associated)

- Simplii Financial No Fee Chequing Account

You can scope out the full list over at MoneySense.

Remember that when opting for a free bank account, you’re making a trade off. Some fees are worth paying if it means you get great financial advice or investment oversight. But that’s up to you.

Do money like you mean it, babes! You got this.

| GET MY FREE MOGOCARD |

This blog is provided for informational purposes only.

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company. Mogo Visa Platinum Prepaid Card is issued by Peoples Trust Company pursuant to licence by Visa Int. and is subject to Terms and Conditions, visit mogo.ca for full details. Your MogoCard balance is not insured by the Canada Deposit Insurance Corporation (CDIC). MogoCard means the Mogo Visa Platinum Prepaid Card.