Budgeting for those who don't like to

Don’t like to budget? You’re not alone. A recent survey showed that 44% of Canadians would rather organize their closet than make a budget. But we have good news, there’s a way to do this that isn’t that complicated and won’t take that long to complete. Most importantly, the time you spend going through this exercise will more than pay off in the end and will be a big step forward in your financial journey.

The 50/30/20 rule is budgeting for those who don’t like to budget. It works because it’s easy and straightforward – no spreadsheets or complex budgeting tools. It should take only 30 minutes to an hour to complete and can easily save you hundreds or even thousands of dollars a year. It’s going to help you get on track to achieve your top financial goals like getting out of debt and accelerating your saving and investing.

The 50/30/20 rule

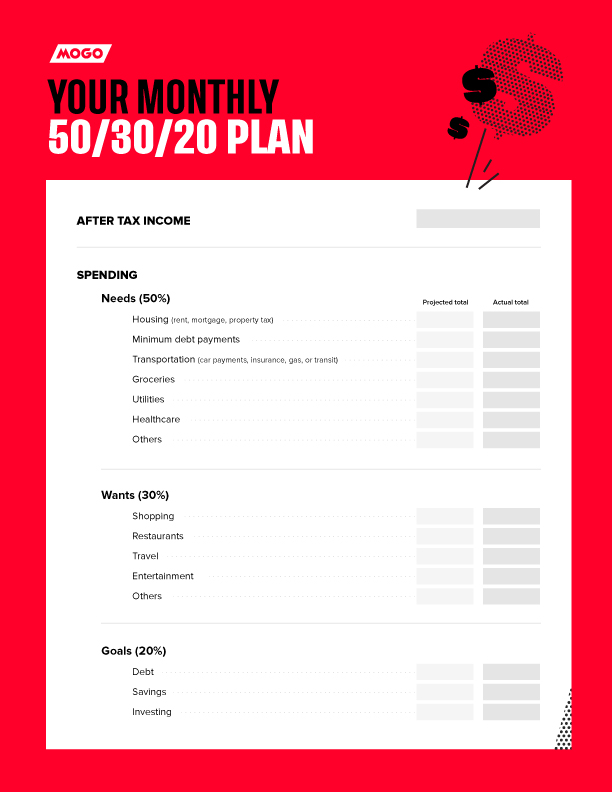

It's simple. Allocate 50% of your after-tax income for needs, 30% for wants, and 20% for goals like debt, savings, and investing. 50, 30, 20. That’s it.

This is a guideline and is meant to be flexible. After going through the exercise you may decide to spend 55% on needs, 35% on wants, and leave 10% for goals – ultimately that’s up to you. Challenging your spending based on this guideline will help you come up with a budget that you feel balances the lifestyle you want to lead today, with the speed that allows you to reach your ultimate wealth goal. Obviously, the more money you can put towards your goals, the faster you’ll achieve them and get on a path to financial freedom. Don’t be worried if you can’t get to your target ratio right away, in fact you should expect it will take some time to get there.

50/30/20 in 4 simple steps

Step 1: Start with your after-tax income

Step 1 is to figure out your after-tax monthly income. You should be able to find this on your pay stub. If your employer deducts health insurance fees and retirement contributions, add those back in as those belong in your needs category.

Step 2: 50% Needs

Now, identify and write down your needs. Needs are those expenses that you absolutely must pay and can’t live without. Here are some examples of needs:

Once you have these identified, tally them up and see what percent of your pay is currently being spent on needs. Remember, the goal is to have your needs make up less than 50%, so if they add up to more than that (which they probably will), you should analyze them and see how you can decrease them. For example, do you really need the car, or could you take public transportation? Are you spending too much on rent and maybe should consider a cheaper place? Just because they are needs, doesn’t mean you can’t lower these expenses.

Step 3: 30% Wants

Next, let’s figure out how much money you are spending on your wants. Wants are things that aren’t essential like new sunglasses, vacations, a gym membership, a new iPhone, and Spotify. This is where you spend money to make life a little more fun, which is great as long as it fits into your overall budget and aligns with your long-term goals. Lots of people end up spending as much on wants as on needs and then have no money left for saving and investing, or worse, they find themselves in credit card debt. What’s even worse is that the things they buy to make them happy actually end up making them very unhappy when they regret their overspending.

Here are some more examples of wants:

Once you have recognized all your spending allocated towards wants, add it all up and see how much of your monthly income you spend on these versus the 30% target. Wants can fluctuate pretty dramatically month to month so you’ll likely have to look through the last few months of your credit card and bank statements, along with any ATM withdrawals, in order to get a good sense of what you spend on wants in an average month. Sometimes we convince ourselves certain wants are necessary spending, but it’s important to think about it and be very strict here. We can’t live without housing or food, but we can live without an extra hoodie, a fancy dinner, or even Netflix.

Try this on for size: Next time you get your credit card bill, pay it off and switch your spending to the MogoCard. If you can't afford to pay it off and make the switch all at once, try making your minimum payment (or more, if you can afford it) and moving the rest of your money to your MogoCard. Then, keep paying off your credit card each month while continuing to exclusively spend with the MogoCard. You'll find that you spend less and less by having more visibility into your transactions and a set budget. Lowering your credit utilization ratio and managing your spending will gradually help increase your credit score.

After all, why not? The MogoCard is a frickin’ triple threat. It’s designed to help you get out of debt, improve your credit score, and, as the cherry on top, shrink your carbon footprint. Win, win, win.

| GET MOGOCARD FOR FREE |

Step 4: 20% Goals

The last category is your goals, and this is where you target 20% of your income. If you’re currently carrying consumer debt on credit cards or other high rate debt (6%+ interest rate) you should focus on paying this off before you start saving and investing.

Now that you have subtotals for needs and wants, what do they add up to? If it’s over 100% of your net income, your current spending patterns aren’t allowing you to save or invest and are actually creating debt. Your target is to get your goals category as close to 20% as possible and you’ll probably have to adjust your spending in other categories to do so. Once you come up with adjusted needs, wants, and goals totals, your challenge will be to stick to your new budget. This is where Habit 02 - Control Your Spending comes into play.

“As VP of Product at Mogo I’m not only passionate about our mission of making it easy for consumers to get financially fit, but I pride myself on being generally savvy around my finances. So when we started researching simple and effective ways to help people budget, I thought, okay, perhaps this could help me a little. Wow was I wrong! I went through the exercise and was shocked at how far off I was. It took me about 30 minutes and then I made changes that will save me over a thousand dollars a year. I’m still making some changes as I’m not close to my target yet, but this was without a doubt well worth the time I've spent. This is a must for anyone who wants to get in control of their finances.”Macully, VP of Product & Engineering at Mogo

Progress not perfection

Remember that 50/30/20 is just a guideline to help manage your spending and challenge yourself to get as close to your targets as possible. If you’re spending at 110% for needs and wants, getting to breakeven is a big step forward. This is a journey, and it’s important to celebrate progress as it will help you find additional wins. The more you focus on the happiness and satisfaction you’ll feel by achieving your top financial goals, the more you’ll be motivated to stick to your new budget.

“What gets measured, gets mastered.” – Peter Drucker

Reviewing things on a monthly basis will dramatically improve your results and is the key to ongoing progress. Don’t worry if you don’t hit your spending goals perfectly, just like being on a workout plan, if you missed a workout, forget about it and get back on track the next day.

A 50/30/20 example

Let’s say your after-tax income is $3,000 each month. The 50/30/20 rule says that every month you can spend $1,500 on needs, $900 on wants, and $600 on goals.

You would be spending well above 50% for needs if you are spending $1,000 a month on rent plus other necessities such as food and transportation. To get down to 50% you need to find ways to reduce your spending on needs, for example relocating or getting a roommate for cheaper rent. You might also decide to temporarily shift some of your wants budget over to cover your needs until they become more manageable.

When your needs happens to be over the 50% limit, look at sacrificing your wants before taking from your goals budget. If you’re overspending on wants, look for ways to cut back and adjust for the next month. If there’s no way to allocate 20% of your income towards your goals, then start with whatever you can, every dollar counts.

Remember, it’s about progress, not perfection. Stick to your plan and keep working towards the 50/30/20 ratio.The faster you take control of your spending, the faster you will achieve your top financial goals like paying off your debt, buying a home, or saving for retirement.

Learn and build money confidence

Get smarter about money with our in-app MoneyClass.