BC first time home buyer benefits

For Alberta click here. | For Ontario click here.

So, you’re buying your first home. Super exciting stuff. As a first time home buyer, there are a lot of exciting steps you’ll be taking – and we’ll be here to help you along the way through the entire experience.

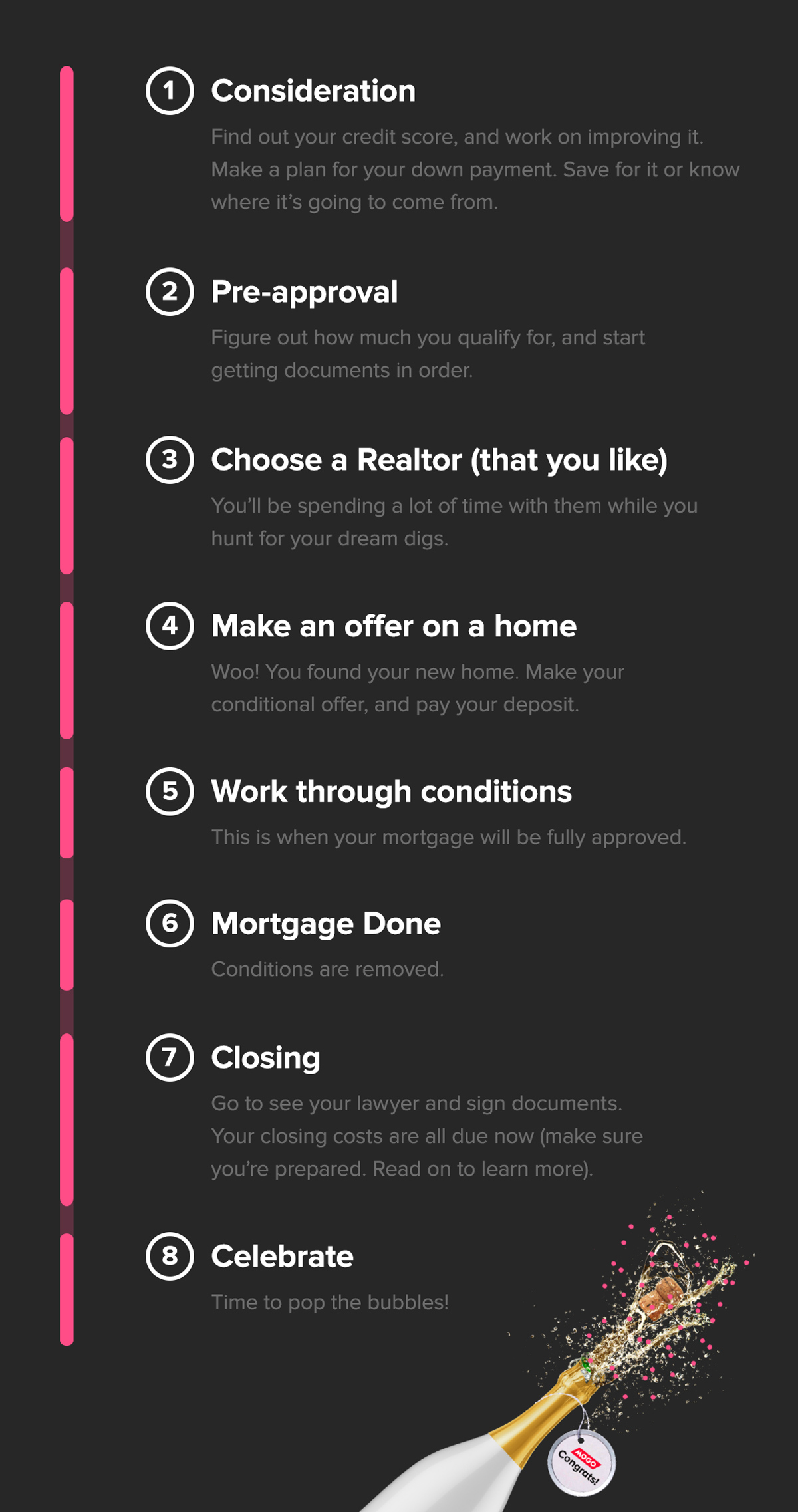

Guide to buying a home

We know it can be a lot. So, we’re here to lighten the (mental) load, and help you be prepared.

Down Payment

How much you need

• If you’re purchasing a home under 500K, your down payment needs to be at least 5%

• If you’re purchasing a home that’s more than $500,000 and less than $1 million the minimum down payment is 5% on the first $500,000 plus 10% of the remaining balance

• If you’re purchasing a home that’s $1 million or more, the minimum down payment is 20%

How to come up with a down payment

But if you’re like most Canadians, you may need to rely on other sources for your down payment...

Home Buyer’s Plan (HBP): If you’re using your RRSP for a down payment, you can withdraw up to $25,000, without paying a tax penalty if you’re a first time home buyer. You’ll need to begin to repay your RRSP two years after you’ve withdrawn the money. You’ll have 15 years to repay the funds. Make sure you meet all the requirements to participate in the HBP. You can read all of them here.

Now that you’ve figured out where your down payment is coming from, now make sure you are planning for closing costs. One of the biggest in B.C. is property transfer tax; luckily as a first time home buyer you could be exempt.

Property Transfer Tax

If you’re a first time home buyer, there are some really sweet tax benefits you can take advantage of when you’re buying a home. They’re different for every province, and they can be a little confusing, so we’re breaking it down for you.

You have to pay property transfer tax in B.C., and it’s due when you’re closing the mortgage.

Property tax amounts:

• 1% on the first $200,000 of the house price

• 2% on more than $200,000 and up to and including $2,000,000

• 3% on anything more than $2,000,000

The First Time Home Buyer’s Program basically reduces or eliminates the amount of Property Transfer Tax you pay when you buy your first home. Which, we know you care about, since buying a home is a big investment (congrats, btw!).

Sweet. How does it work/What’s in it for me?

• If your property is less than $475,000 you don’t have to pay the tax. Score! You just have to make sure you meet the requirements below.

• If your home is between $450K and $500K you may qualify for a partial exemption.

On to the nitty gritty.

To qualify for the full exemption…

You must be:

• A Canadian citizen or permanent resident

• Have never received a first time home buyers exemption or refund

• Have lived in B.C. for a year (12 consecutive months) immediately before the date you register the property or filed at least 2 income tax returns as a B.C. resident in the last 6 years

• Never have owned a home (that you lived in as your main residence) anywhere in the world at any time

• Located in B.C.

• Only be used as your principal residence

• less Be 1.24 acres or smaller

You may qualify for the partial exemption if...

• If your home is between $450K and $500K

• And meet all the above requirements

Here’s a handy little chart that can help you figure out how much you qualify for.

Also, important to note: If one or more of the people purchasing the home don’t qualify, only the percentage of interest that the first time homebuyer's have in the property is eligible.

For example: If you (the FTHB) owns 60% of the property, 60% of the tax amount is eligible for the exemption.

Newly Built Home Exemption

How does it work/What’s in it for me?

• If your property is newly built and is less than $750,000 you don’t have to pay the property transfer tax.

• If your home is between $750K and $800K you may qualify for a partial exemption.

• A Canadian citizen or permanent resident

• A newly built home

• Located in B.C.

• Only be used as your principal residence

GST

Good news – you typically only pay GST (5% which is normally added to your purchase price) if you’re buying a newly built home from a builder. (for example, you bought a pre-sale condo.)

But…If you fall into the category of buying a brand new place, there’s a potential partial exemption on the GST.

Here’s the deal.

If your new home is priced below $450,000 before GST/HST, you may be eligible for a partial rebate of the 5% GST portion. The GST/HST New Housing Rebate amount changes on a sliding scale, depending on the purchase price of your home. For example, if it was priced at $350,000 or less, your GST might be reduced to just 3.5%.

The only catch – the home must be your primary residence.

Phew! We know that’s a whole lot of info. Don’t worry you don’t have to memorize the above, we’re going to be here along the way to help you with all the details. And, if you’re still have questions, concerns, just feel like chatting, our Mortgage Specialists know the ins and outs and are here to help. You can Live Chat with them, or shoot them an email here.