Focus on habits, not goals

Now that the new year is under-way, we thought it would be a good time to check in and see how you’re doing with your New Year’s resolution. Every year one of the top New Year’s resolutions made by millions of people is to “get out of debt and save money”. But according to a U.S. News & World Report 80 percent of these resolutions fail by February, so what are we to do?

Goals are outcomes that are achieved by consistent behaviors or habits. According to Charles Duhigg author of The Power of Habit: Why we do what we do in life and business, 40% to 45% of our daily decisions are actually habits. If your goal was to be physically fit, it’s the daily habit of exercise and healthy eating that would actually get you the results.

So if you want to achieve a goal like getting out of debt and saving money, focus on mastering the habits that will actually get you the results. Once the motivation and excitement of your new year's resolution wears off, it’s your habits that will end up determining the results you get.

4 Habits of financial health

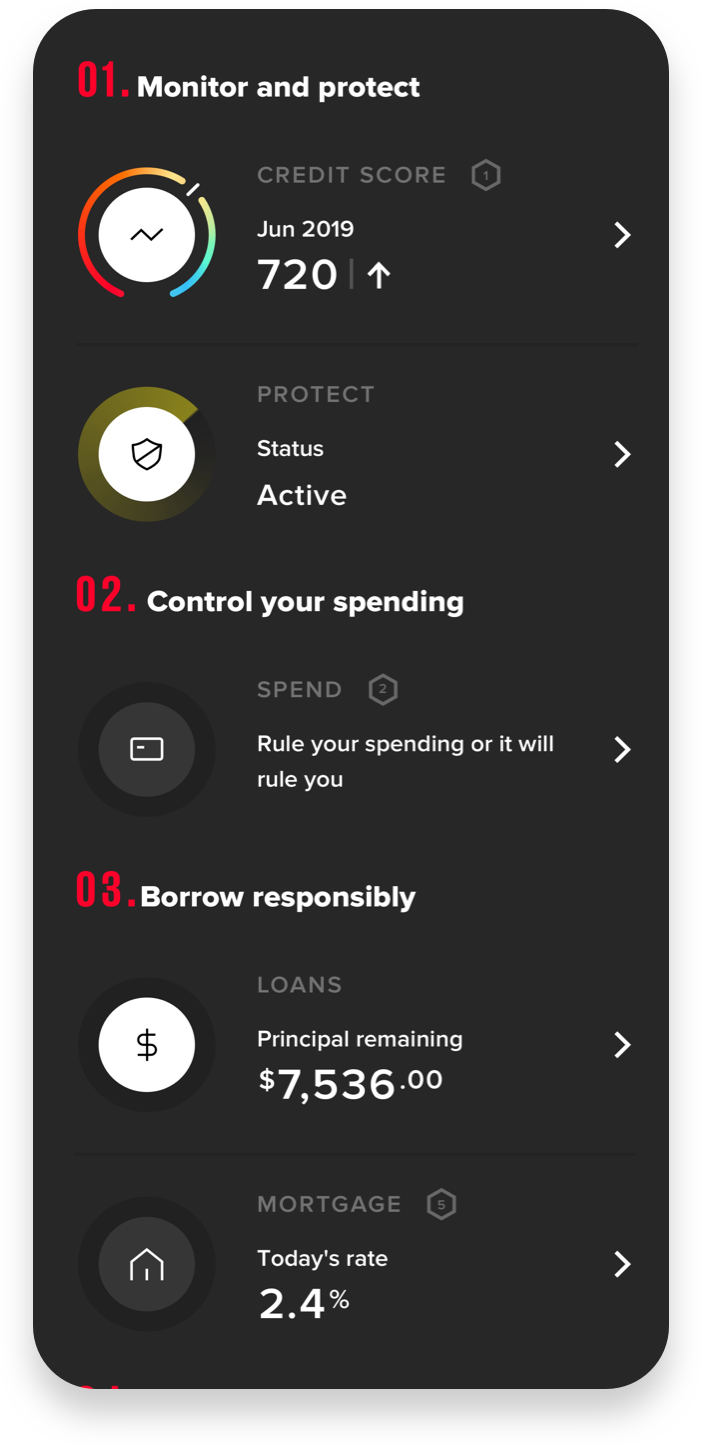

The Mogo app has been designed around the 4 habits of financial health, and through our all new in-app MoneyClass you can learn what you need to master the 4 habits of financial health.1

Habit 01 | Monitor and Protect – learn why your credit score is important and how to improve it, and why you need to ensure you protect yourself against identity fraud.

Habit 02 | Control your spending – getting out of debt, or saving more money comes down to how well you control your spending. From your account dashboard, go to "Spend" to learn how you can get more control over your spendingand accelerate how quickly you can achieve your goals.

Habit 03 | Borrow responsibly – sometimes we need to borrow money, but the key is to do it mindfully and focus on paying it back as soon as possible so you can get back to saving and investing. Learn the keys to mastering your debt.

Habit 04 | Save and invest wisely – the key to building wealth comes down to a consistent and intelligent investing. Learn the keys to building wealth including how you can retire with up to $1 million more by avoiding certain fees.

Don't have the app? Get it now.

1 - About MoneyClass: MoneyClass and related content is provided for informational purposes only, is not intended as investment advice, and is not meant to suggest that a particular investment or strategy is suitable for any particular investor. If you’re unsure about an investment, you may wish to obtain advice from a qualified professional. Nothing herein should be considered an offer, solicitation of an offer, or advice to buy or sell securities. It’s also important to remember that past performance is no guarantee of future results.