Setting your sights high early is key to retiring with comfort

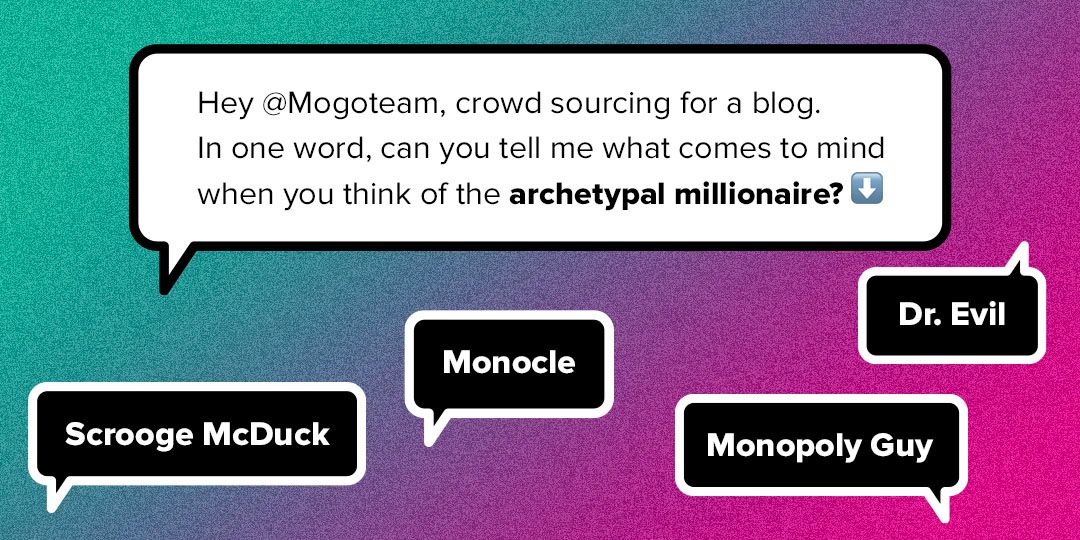

What do you think of when you think of millionaires?

For us, it’s a mixed bag:

Maybe… actually… not that mixed. Lol. Millionaires have a bad rap and it’s easy to see why. Most movie supervillains? Millionaires. Whoops! We said it!

Okay, now hear us out. Get out your phone and open your camera. Flip it to the front facing lens. Get over the initial shock of seeing yourself from this angle. It takes a sec. Now find a cute angle and take a cute lil selfie.

That babe? In that cute lil selfie? Can and should be a millionaire. We like you way better than we like monocle and/or Monopoly guy.

(Scrooge McDuck does hold a special place in our hearts but only because he learns to see the error of his ways.)

We’re not jerking you around and we’re not selling some miracle cure. This is not a multi-level marketing scheme. No, this is real talk about your ~*number*~. The one you really could aim to retire with. Spoiler: for many of us, that number is over one million dollars.

Looking for an easy way to get started on budgeting? Check out the link below to get MogoCard!

| GET THE MOGOCARD |

One Million Dollars Can Be An Entirely Feasible Goal

Because of the way our economy has grown in the last few decades, and because of the way stock market indexes like the S&P 500 have continued to perform, one million dollars can be entirely within reach for many folks.

This reality is in part because of inflation; one million dollars seemed like a ton of money in the 1950s because the cost of living was so much lower.

Today, the cost of living is much higher. But the median increase in wages and steady stock market returns mean that a lot of us are able to get our savings into the market (carefully and responsibly!) and see really consistent returns.

These returns will compound. With any luck (and by starting early), by the time you reach age 65, you could have a huge chunk of change to retire on, cozy and still earning interest, tucked away in your bank. We all deserve a relaxing, worry free retirement, and investing smartly at an early age is key.

Retiring With A Million Dollars

Year over year, as you add more money to your portfolio of assets, your wealth will grow faster. One way to build up wealth (without help from your parents or winning the lottery or what everrrrrrr) is the consistent investment of up to 20% of your income over as long as you can manage.

Here’s an example calculation for you, straight from our very own brainiacs (they’re v good, v brainy). Just look below at the acceleration of building wealth once that first million dollar milestone is reached.

~*~NuMBeR tiME*~*MaTHs~!*~

Say you’ve got a $40,000 gross annual income and can swing 18% savings. If you keep saving this 18% for 60 years, it could turn into over $20M, assuming an annual rate of return of 10%. Yes. Twenty. Cool. Millions. Here’s how:

Let’s say 18%, or ~$7,200 per year, which is $600 per month of your gross income, goes into the S&P 500. (While it’s by no means a guarantee of what the future will hold, did you know that that bad boy has seen returns of just over 13% in the last decade?)1

If the S&P 500 has an average annual rate of return of 10% for the next 30 years, then that $600 per month invested into the S&P 500 would to turn into $1.238M in 30 years.2

(This means if you’re in debt at 30 years old, and you manage to pay off that debt by the time you’re 35, you could still have $1M+ by retirement time!)

Then things pick up speed.

After 40 years, you could have $3.33M in the bank.

After 50 years, you could have $8.76M in the bank.

After 60 years, you could have $22.8M in the friggin bank.

Do you see that insane acceleration? From hitting one million after 30 years, all the way to hitting $22 million in 60? This is the magic of compound interest . Money makes more money.

Find Your Number

To find what you can reasonably put away monthly, we recommend using the 50/30/20 Rule. This rule of thumb says that (once you’ve paid off your debt) 20% of your income should go to your savings. You can find this number by multiplying your annual income by 0.2, and then dividing by 12 to get your monthly contribution amount.

For example, if you make $35,000 per year, try 35,000 x 0.2 = 7,000. That’s $7,000 you could consider investing every year, or $583.33 per month. Using the same assumptions as before (a monthly contribution of $583.33, with a 10% annual return and interest compounded annually) after about 30 years, you’d have around $1.2M in the bank. That’s the rule in action: time and consistency.

Aim High, Start Early

We don’t all want to be gazillionaires. We don’t all want to be super villains.

But most of us want to be comfortable.

We want to travel, not worry about our bills, eat good food, help our kids with tuition, buy gifts for our friends and family, be able to give back to our community, and enjoy the occasional life splurge. For most of us, being able to achieve these goals requires implementing solid financial strategy.

Anyone that says money can’t buy happiness is lying, because of course in some ways it can. We feel *very* happy if we don’t have to worry about making rent or paying bills. We can’t all be Jeff Bezos. But we can, with the right tactics, live a very comfortable, engaging, exciting life.

So it’s time to get proactive and start saving. The sooner you get into it, the better off you’ll be. Do some research and decide what the best investment strategy is for you. If you’re not sure, call up your financial advisor and tell them you’d like to retire with a million dollars—or more. Then get to work.

| CHECK OUT MONEYCLASS |

This blog is provided for informational purposes only, is not intended as investment advice, and is not meant to suggest that a particular investment or strategy is suitable for any particular investor. If you’re unsure about an investment, you may wish to obtain advice from a qualified professional. Nothing herein should be considered an offer, solicitation of an offer, or advice to buy or sell securities. It’s also important to remember that past performance is no guarantee of future results.

1- Past performance is not a guarantee of future results. For more information on the historic performance of the S&P 500, refer to: Knueven, Liz. “The Average Stock Market Return over the Past 10 Years.” Business Insider. Accessed February 26, 2021. https://www.businessinsider.com/personal-finance/average-stock-market-return.

2 - A $600 per month contribution into an investment with an annual rate of return of 10%, compounded annually, over 30 years will result in an investment with a total value of $1,237,705.99. This calculation, and all others contained in this blog, were calculated according to the Ontario Securities Commission Compound Interest Calculator, found here: https://www.getsmarteraboutmoney.ca/calculators/compound-interest-calculator.