#AskAnAdult: What’s your day rate?

How much money do you need to survive a day? Not sure? Financial Fitness Coach, Chantel Chapman, has some tips and tricks to help you budget your money.

This week on the Kastor & Pollux blog, the adulting question comes from Alyssa Lau, owner of super cool minimalist fashion-line, New Classics Studio. She asks:

Another one that gets me is app purchases and subscriptions. For example, when people subscribe for things like music streaming apps, on-time payments are automatically set up. For that reason they can be suuuper easy to lose track of! I like to limit myself to 2 apps that I absolutely need and 2 apps that I really want – it adds up to about 40 bucks a month on average which I think is totally reasonable for anyone’s budget!

Here are some of my personal budgeting tips:

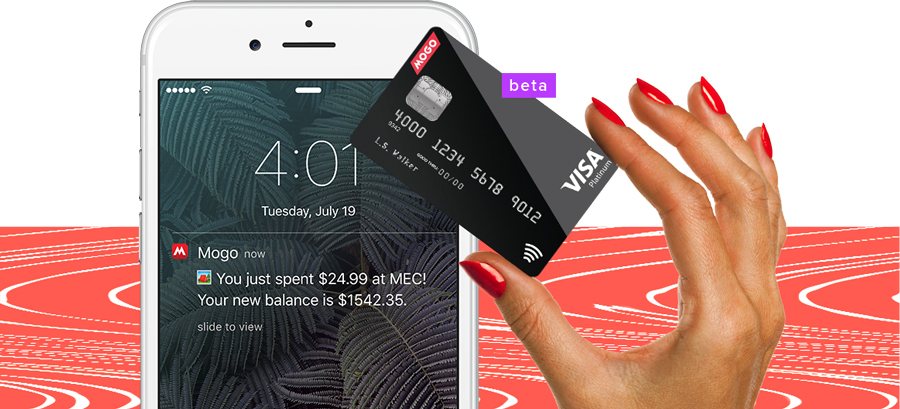

• Set a day rate playa: Calculate how much you spend on stuff that gets you through the day and don’t go over that rate. There is a golden rule to this though: don’t ever borrow from the future (duh). If you don’t spend it all in one day, you can carry forward that $$ and maybe F*CK UP SOME COMMAS! This method works so well that Mogo’s added a “Daily Spend” section on our MOGOCARD account.

• Give yourself some “RICK ROSS” money. Rick likes to BMF (Blow Money Fast), and sometimes so do I. To keep myself in control with my spending, I give myself some money that I can spend guilt-free each month. Ironically, the success to budgeting is to give yourself a little money each month to BMF. It’s like dieting: if you eliminate carbs, sugar, gluten and fat all at once, I can pretty much guarantee that you’re going to have a cheat day 7 days a week and start sweating when you see donuts.

My preferred method is to sit myself down, write out how much of a financial sh*thead I am on a day-to-day basis and create my monthly (or weekly for all you keeners) budget based on those numbers. Budgeting is not complicated, but if you need an outline there are a lot of great templates on the internet! Doing it old school makes you more mindful. Pairing this with smart tools like an account just for your spending and my tips above will keep you in shape.

Some of these tips that I’ve told you have conveniently been included in some way onto the MogoCard - it’s currently in Beta, so download our app, and get in line because you'll love it. You can load your daily budget onto it and it texts you every time you spend so you know how much money you have left. It’s the closest you can get to being treated like a child while being an adult.👊

In the meantime, sign up to be a MogoMember to get our email newsletter with the latest money tips!

Chantel Chapman is Mogo's Financial Fitness Coach and Credit Score Expert. She teaches you how to be an adult, and is also the host of our Adulting 101 events. With over a decade’s experience as a mortgage broker, Chantel recognized a need for financial education with many of her first-time homebuyers, so she began creating custom content to help guide them. Chantel is the founder of Holler For Your Dollar, a consulting firm that jump-starts anyone who’s ready to dive into the world of Adulting or entrepreneurship. Her role at Mogo puts her skills to use creating and teaching digestible, educational financial literacy content geared to millennials and daring entrepreneurs.