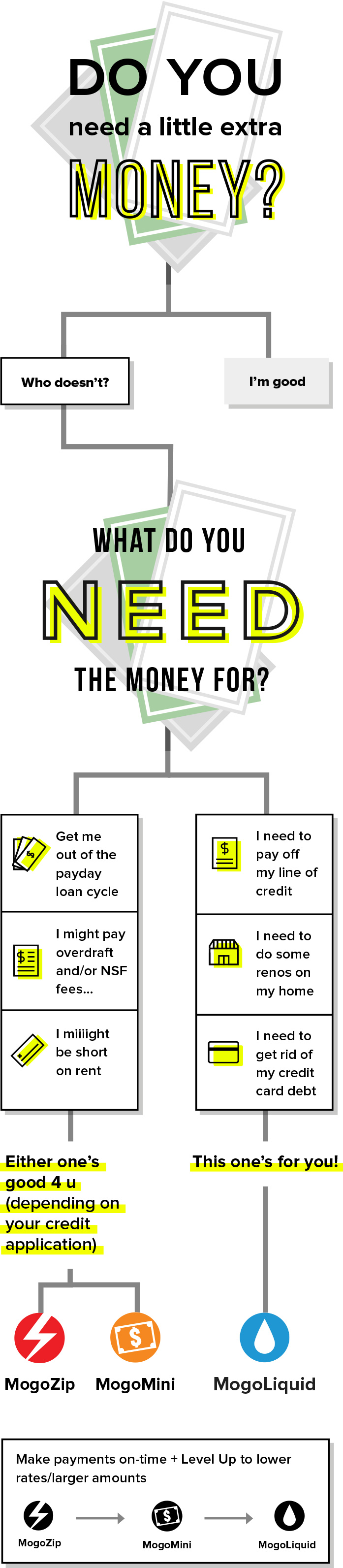

Better than payday loans: which Mogo product is right for me?

MogoLiquid. MogoMini. MogoZip. Depending on what’s going on in your life, you might be needing one of these MogoMoney loans. But which one?

Now that you've matched with a MogoMoney product, find out more about it!

Get out of credit card debt with MogoLiquid

Borrow up to $35k; rates start at 5.9%†

MogoLiquid’s a personal loan that’s the perfect way to pay off your credit cards. MogoLiquid’s also a good option if you’re determined to pay off your line of credit (because payments are usually set up to go toward interest only), need new appliances, have to buy stuff for your small business, you get the idea…

Avoid paying overdraft and NSF fees for your bank account with MogoMini

Borrow up to $3500; 47.71% AIR

Payday loans suck—get MogoZip

Borrow up to $1500; rates start at $10.50/$100*

If you get MogoZip in BC or Ontario, you can save up to 50% compared to a payday loan**. That's a hefty chunk of change. Not only that, with Mogo's Level Up program, you can earn lower rates and/or larger amounts when you make your payments on-time, see website for more. (You can move up to MogoMini in as few as four payments!) Is that better than a payday loan or what?