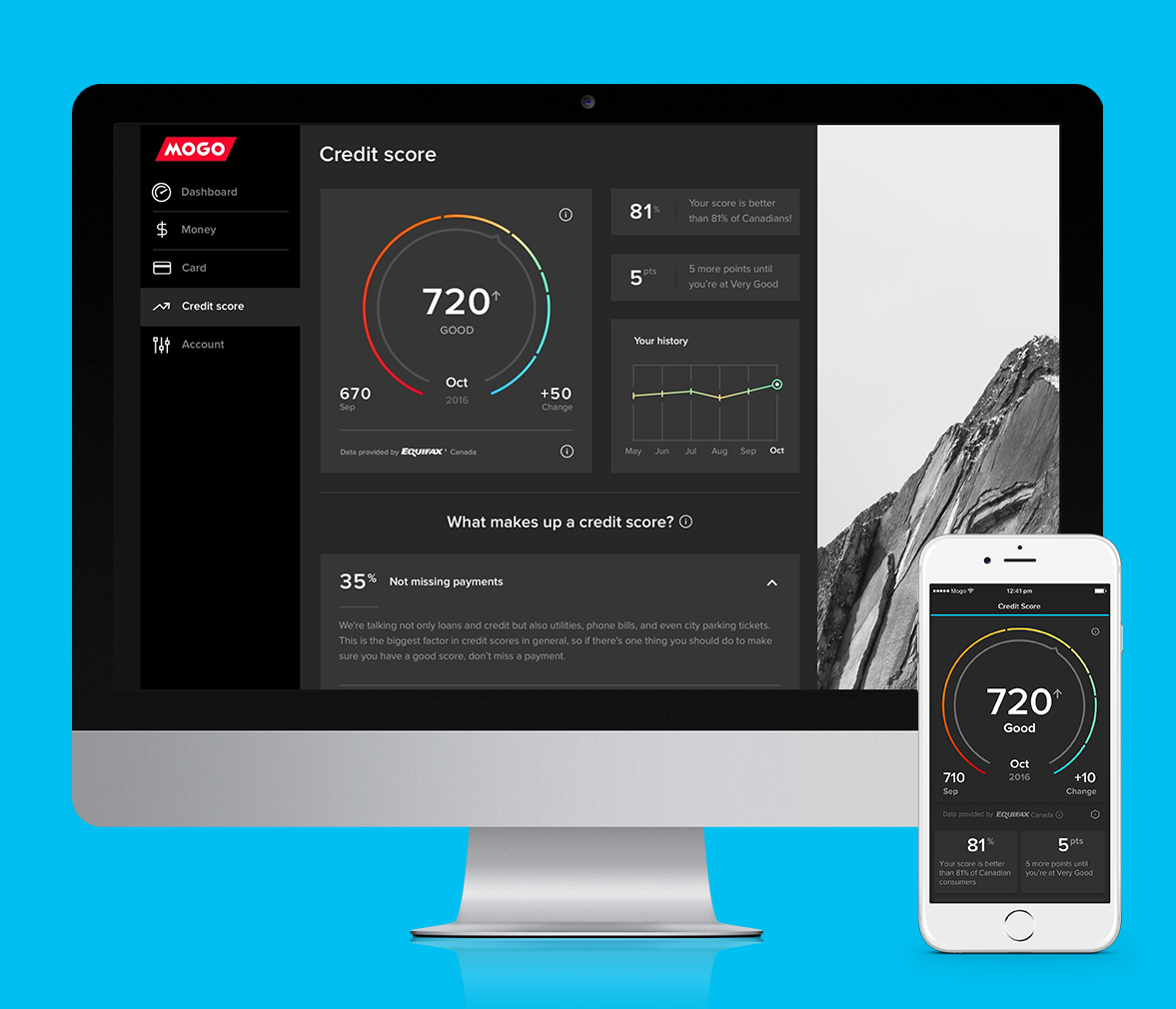

Your Mogo Credit Score

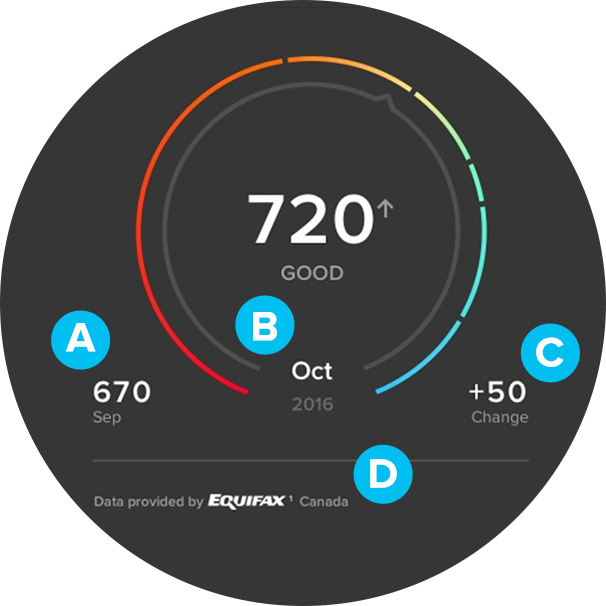

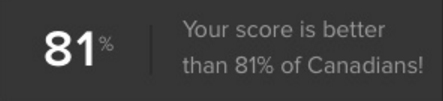

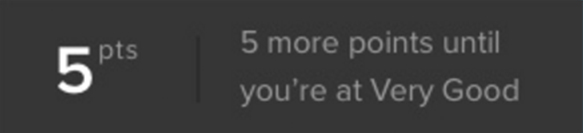

We’re the first company in Canada offering free credit score with free monthly credit score monitoring - and it doesn’t impact your credit score. Your credit score is basically your adult report card. It’s a great indicator of your financial health and it’s used to determine your eligibility for things like getting a mortgage or even renting a property. Our new dashboard gives you a full view of your credit score, with monthly updates, and info on how you stack up to other Canadian’s scores. We break it all down for you below.

How Is My Equifax Mogo Score Different?

For those of you who may have checked your credit score somewhere else, you may notice a difference in the score you were given vs. the one we give you. Your credit score changes every day and credit bureaus each have different credit score reports as well. Mogo has chosen to partner with Equifax the largest bureau in Canada and the score we are showing is technically known as ERS2 and includes mortgage information. The benefit of monitoring your score with Mogo is that the score we show (ERS2) is one of the main scores that many lenders consider when looking to grant you loans including mortgages.

What Impacts My Credit Score?

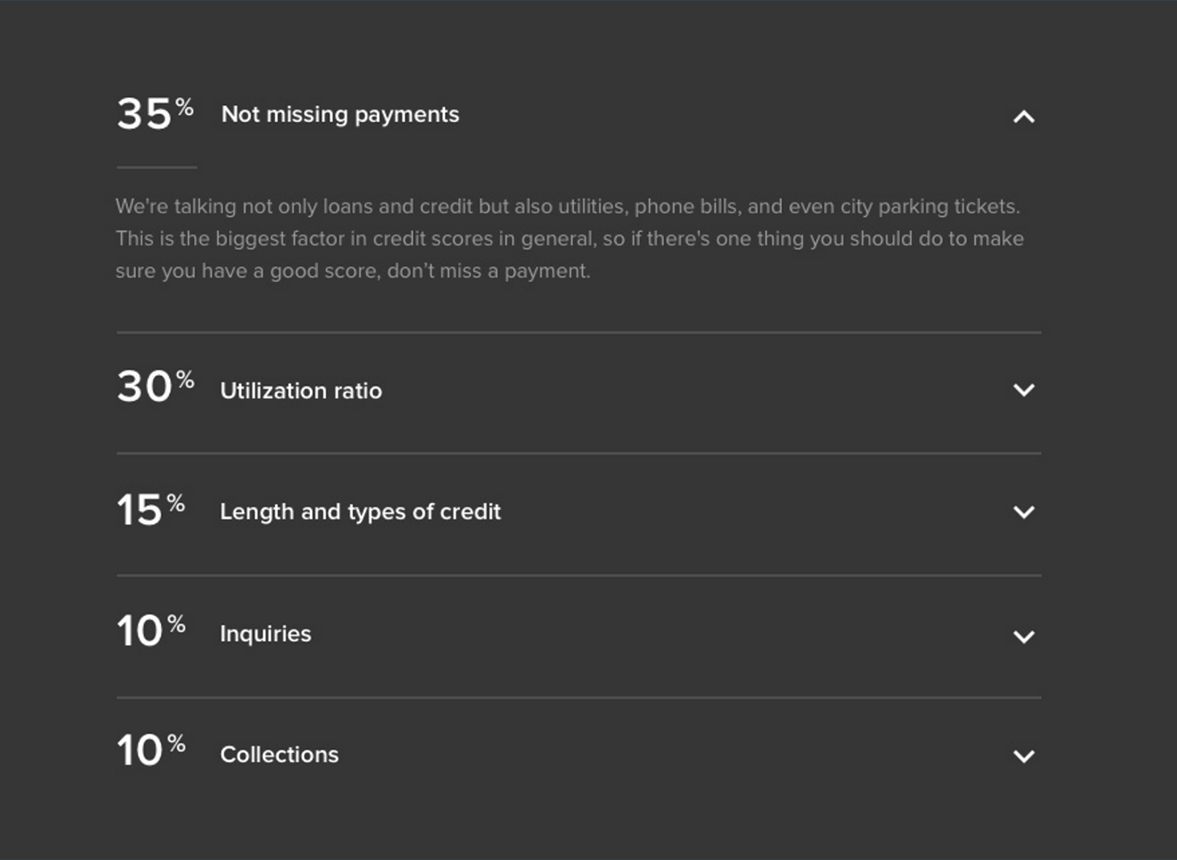

Ever wondered how your credit score is calculated? Credit scores are dynamic, and are based on a secret credit bureau algorithm made up of different aspects of your credit history. But don’t worry, we can give you a rough estimate of the factors that make it up. This can help you figure out where you can improve (and where you’re kicking ass).

Payment history

This makes up about 35% of your score, so pay your bills on time. Missing a $4 dollar payment on a credit card for example could be as bad a missing a $400 payment, so don’t skip the minimum payment. This also includes collections. Some creditors (even city parking ticket collectors) may report that you haven't paid them to your credit bureau, or even use a third-party collection agency to get their money back. These collections on your credit bureau can lower your score. Always be aware of whom you owe money to—even if it's just a parking ticket.

Utilization ratio

This is your level of indebtedness. This is how much of your total available credit you're using. Try to keep your balance below 35% of your credit limit, and don’t ever go over 70%, even if you pay it off every month.

Length of credit

The longer you have an account open, the better. Think of it as a good track record. It shows you’re capable of managing credit like a responsible adult should.

Types of credit

It's good to have a mix of different types of credit (revolving credit like credit cards and lines of credit are riskier than personal loans so it’s better to have fewer of those in your mix) to show that you can handle your payments.