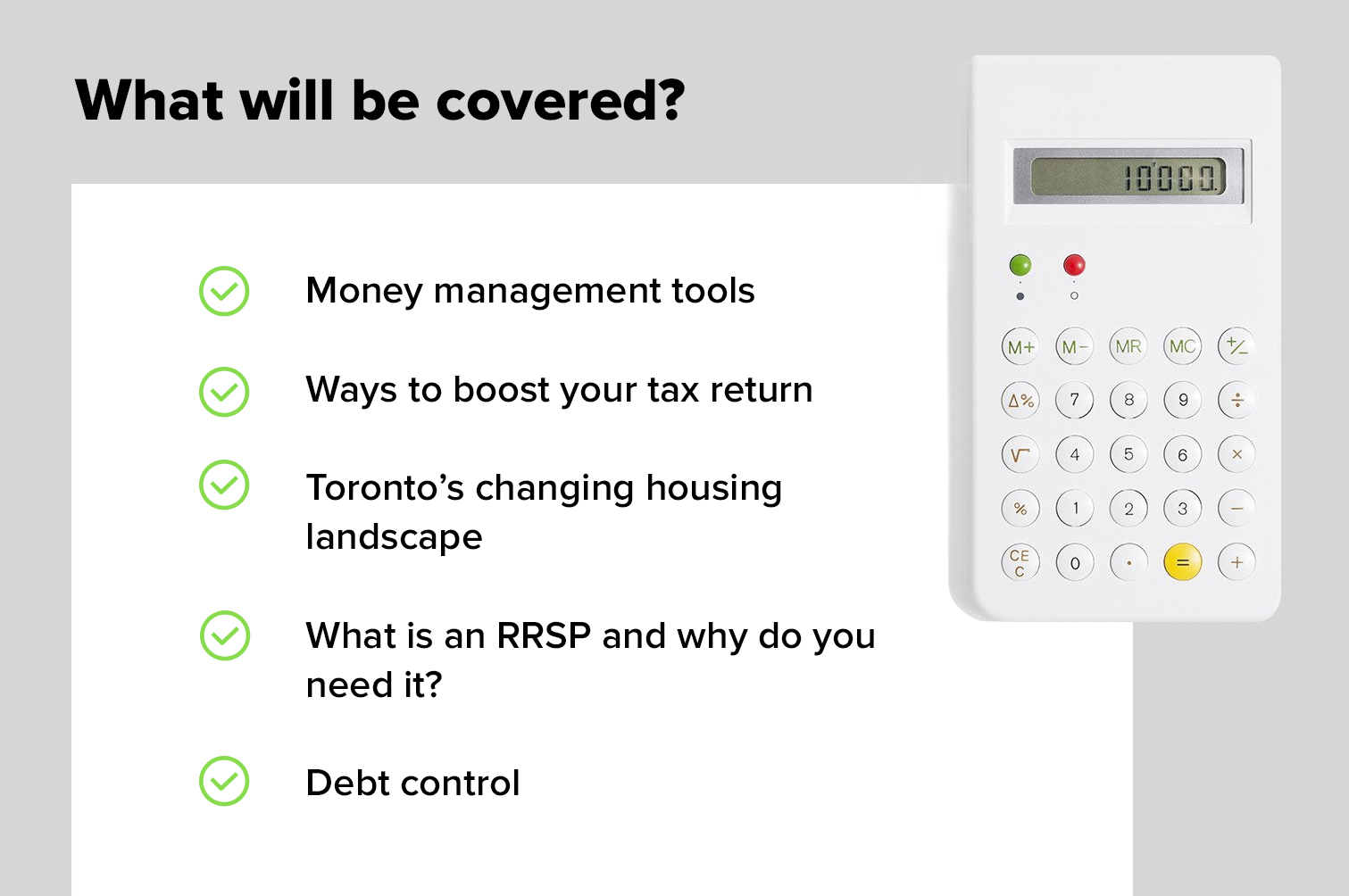

RULE YOUR FINANCES: Financial Literacy Series

Join us for an evening of drinks, light snacks and financial advice at the

MogoLounge. We'll be talking ways to rule your finances.Where:

The MogoLounge

797 Queen St W,

Toronto

When:

Wednesday July 5th

from 6:30–8 PM

Can’t make it

to the event? Submit questions via our Social channels (Facebook

[https://www.facebook.com/mogomoney/], Twitter [https://twitter.com/mogomoney/],

Instagram [https://www.instagram.com/mogomoney/]) usin