Don't be a sucker for rewards points

While non-rewards credit cards entice you to spend more than you have, rewards cards further tempt you by backhandedly rewarding you for putting yourself in debt, therefore increasing interest payments.

A typical credit card rewards program will give you the equivalent of $10-$20 in rewards value for every $1,000 you spend. Don’t be a sucker who overspends by thousands of dollars just to earn a few dollars in rewards.

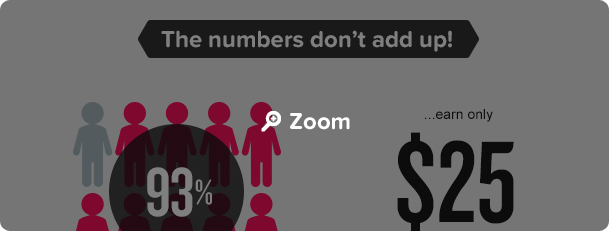

Quite frankly, the numbers just don’t add up. A recent study found that 93% of rewards credit cardholders overspend more money than they earn in rewards. It’s no surprise; why would a credit card company go out-of-pocket for our flight to Mexico (albeit off-season and a triple connection)?

Quite frankly, the numbers just don’t add up. A recent study found that 93% of rewards credit cardholders overspend more money than they earn in rewards. It’s no surprise; why would a credit card company go out-of-pocket for our flight to Mexico (albeit off-season and a triple connection)?

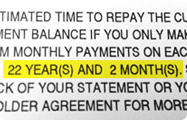

If you’re using a rewards card, not only are you being sub-consciously urged to spend more but you’re also paying off less debt at month end. A report by the Federal Reserve Bank of Chicago found that a 1% cash back rewards program rewarded cardholders an average of $25 each month, but also prompted them to spend an average of $79 more per month. The overspending contributed to an average increase of $191 in revolving credit card debt. That’s $191 you could have been using to pay down your balance.

Click the image to see more. Sources: Federal Reserve Bank of Chicago, Mozo

That’s a losing calculation even without adding the high annual fees most rewards cards charge – some of the biggest rewards card programs in Canada are charging over $100 a year!

BMO AIR MILES World MasterCard: $99/year

CIBC Aerogold VisaTM Card: $120/year

RBC Avion Visa Card: $120/year

That’s why we have kept the Mogo Card Rewards Program as straightforward as possible; the reward for using the Mogo Card is only spending what you have, therefore staying in control of your finances and avoiding years of high interest payments.

That’s why we have kept the Mogo Card Rewards Program as straightforward as possible; the reward for using the Mogo Card is only spending what you have, therefore staying in control of your finances and avoiding years of high interest payments.

Another superior difference between the Mogo Card and other major credit cards is that our Mogo offers a $0 annual fee. We’ll set you up with a free card design and, since it’s a prepaid card, there’s no credit check required.

Our goal is to help save Canadians $1-billion in credit card interest, bank account fees, NSF fees, overdraft charges and payday loan costs.

Trying to create major change in an industry as stubborn and archaic as banking isn’t easy, so it’s important to do it with like-minded people who can spread the word and bring new ideas and a ton of fun to the table every day – like you!