Valentine’s Day is nearly here. Consider this your early reminder! We want to make sure our readers are doing it right in 2014, and avoiding the holiday pitfalls that are easy to get caught up in.[](https://www.mogo.ca/mogo-prepaid-visa-card-gallery?loc=blog)

There are plenty of mistakes one can make (forgetting the day, writing the wrong name on the card, getting flowers your date is allergic to), but the biggest mistake is getting stuck in the Valentine’s Day spending trap. Just like any big event, it’s easy to overspend, to try and make things special.

What we spend

According to the National Retail Federation, our friends south of the border will definitely be spending to celebrate the 14th:

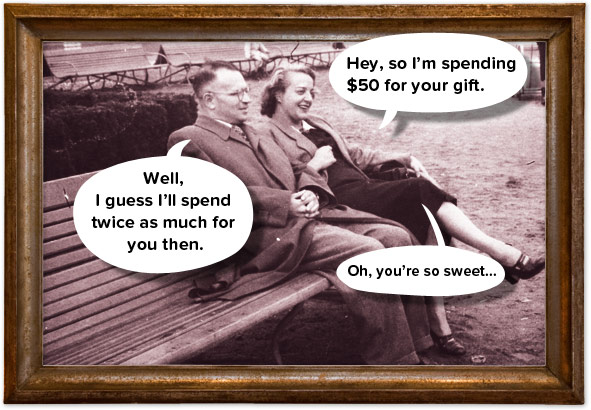

> Men will spend $108.38 on gifts for their significant others – twice as much as women who will spend $49.41 on their special someone.

Now, that seems fairly reasonable, until we dig a bit deeper into the numbers and see what the 25-34 year old age demographic spends:

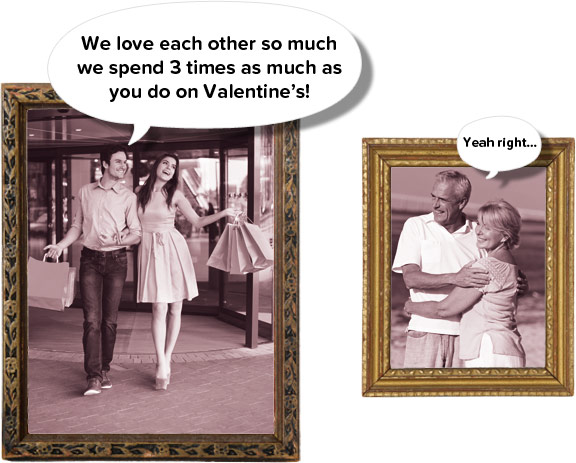

> 25-34-year-olds will spend an average of $204.03 (up 15.4% from $176.85), almost three times the amount ($68.14, down 14.5% from $79.67) adults 65 and older will spend.

giphy.com / Paramount Pictures

This is the Valentine’s Day spending trap! Those of us that are young, foolish, and in love are ready to increase our spending just because of a date on the calendar. But what happens if you can’t afford what you’re spending? A big bill, unnecessary debt, and a headache that will stick around long after the 14th.

## How to avoid it

Know what you want to spend, and spend it. [It doesn’t matter what holiday it is](http://blog.mogo.ca/2013-christmas-spending-guide-a-how-to-guide-on-avoiding-spending-aftershock/#.UvO4X2SwJcU), if you’ve set a limit on spending, and actually stick to it, you’re going to have a better time than if you spend wildly – and decide to deal with the outcome later.Looking for more help? Turn to your trusty [Mogo Prepaid Visa Card](https://www.mogo.ca/how-the-mogo-card-works). There really isn’t an easier way to control your spending.

It’s cheesy but it’s true

Most importantly, the best thing to spend on the 14th is *quality time*. Remember why you’re spending, instead of what you’re spending – and the rest should take care of itself.