Monitor your finances to protect against identity fraud

Protect your passwords. Shield the PIN pad while using an ABM. Sounds familiar? When it comes to protecting yourself from identity theft, are these enough?

Time for a reality check — in our digital world, no one can really prevent identity theft. We enjoy the convenience of services like Uber, Amazon, Netflix and Airbnb, but we’re exposing also ourselves to greater risk for identity theft and identity fraud.

Time for a reality check

Even if you don’t have any online activity, but only have a bank account, credit bureaus already have your personal information. There is as high likelihood that some of your personal data has already been hacked.

The Canadian Anti-Fraud Centre recorded more than 20,000 victims of identity theft in 2014 alone, with losses amounting to more than $10 million. This doesn’t include the 95% of estimated unreported fraud cases.

The cost of identity fraud

Every day, we’re hearing about data breaches by major companies. A stolen identity could seriously derail your financial health. It can take years to recover from identity fraud. You may be forced to put your life plans on hold while you try to salvage a damaged credit rating. Imagine being denied your dream home because of identity fraud!

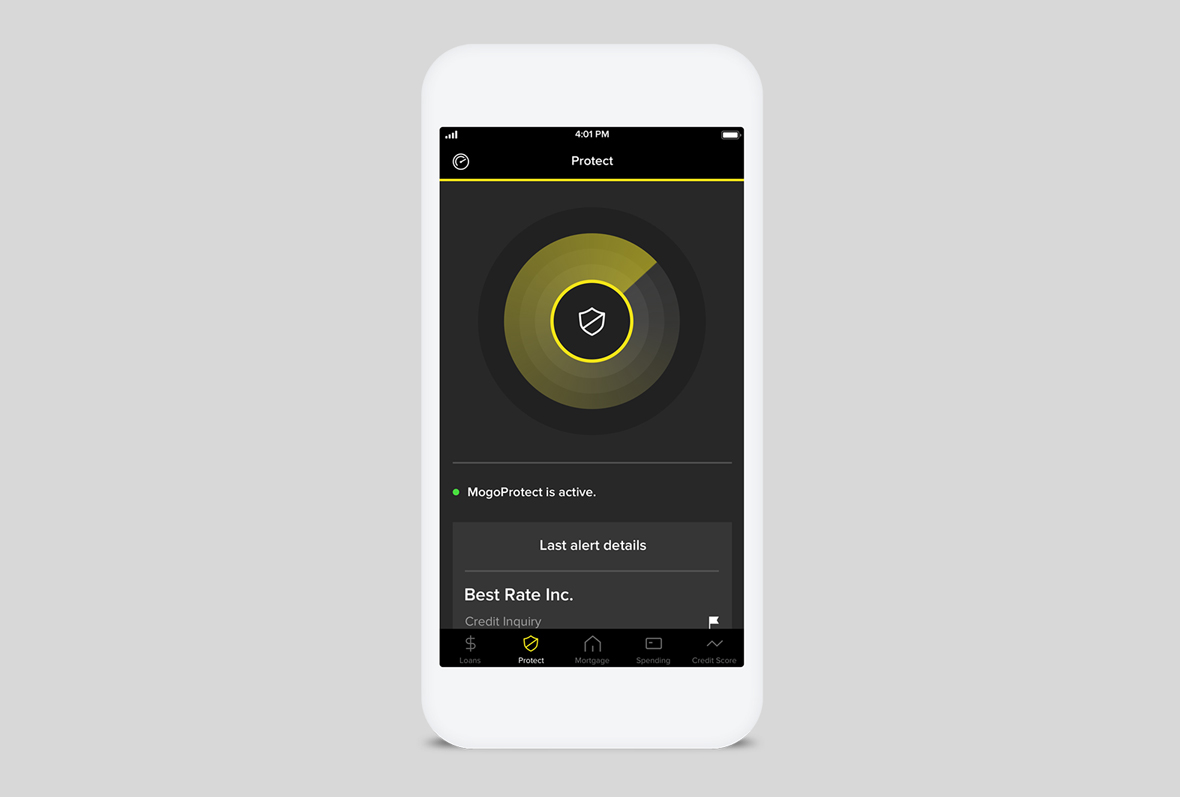

Introducing MogoProtect

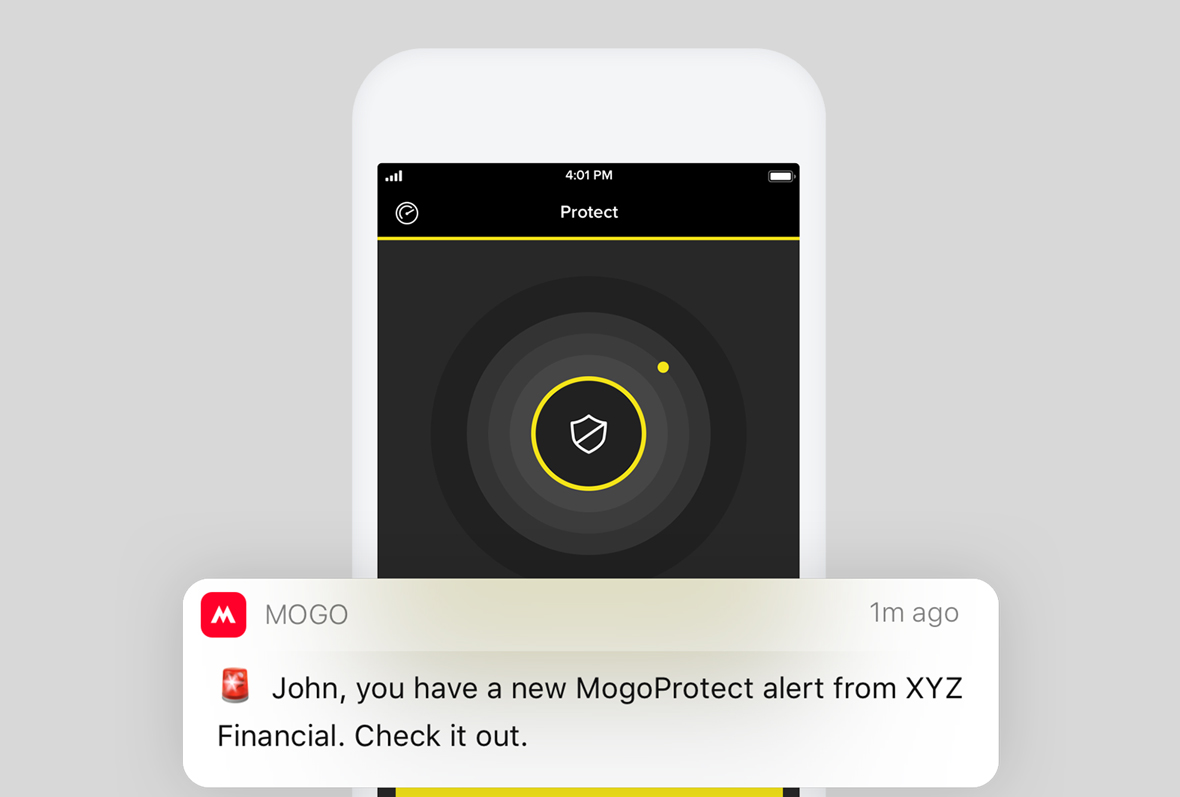

Designed to help you protect yourself against identity fraud, MogoProtect monitors your credit bureau daily for inquiries. We’ll notify you whenever a company makes an inquiry into your Equifax credit bureau, which happens when your name is submitted to open a new account or complete an application for credit1. Available for just $8.99/month, it’s roughly half the price of comparable services2.

Take action

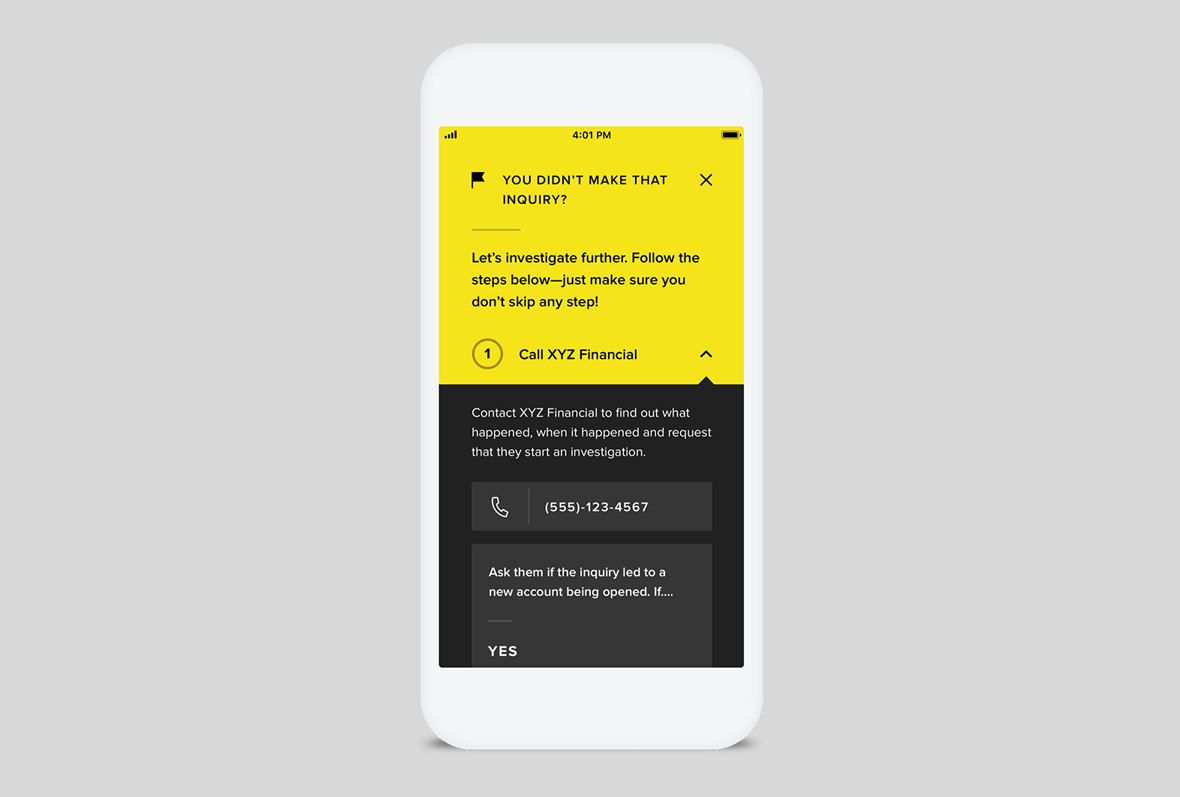

If you receive an alert for a credit inquiry that you expected, no harm done! But if it’s an inquiry you didn’t expect, MogoProtect will guide you through the next steps to help stop fraudsters in their tracks. Getting alerts on unexpected credit inquiries is key in helping you identify potential fraud before it becomes a real issue.

Time is critical

Take the story of this Toronto woman, whose identity was stolen. Thieves tried at 12 financial institutions to register 2 mortgages totalling $500,000. They failed at 10 financial institutions, but succeeded at 2 of them. If she had MogoProtect, she would have been alerted when each of those lenders reported an inquiry to Equifax. She could have prevented the fraudsters from closing the mortgages between the time of application and closing.

Help protect yourself against identity fraud

1. No one can prevent all identity fraud and Mogo does not monitor all transactions at all businesses. Currently, Mogo only monitors inquiries into the Equifax® Canada Co. credit bureau and will provide push and email notifications within 24 hours of the inquiry being reported. Refer to the MogoProtect Terms & Conditions for more information https://www.mogo.ca/pdfs/MogoProtectTermsAndConditions.pdf. 2. You will be required to provide your payment information when you subscribe for MogoProtect. Mogo will immediately charge $8.99 (inclusive of tax) to your payment method and will continue to do so on a monthly basis until you cancel your MogoProtect subscription. To cancel, log in to your MogoAccount at www.mogo.ca and go to Account Settings. There are no refunds or credits for partial months. Refer to the MogoProtect Terms & Conditions for more information.