Budgeting sucks, but everyone has to do it. Playas gotta play, and you gotta have $$ to play - that wine date ain’t paying for itself. Besides, not budgeting is like never cleaning your apartment and then being shocked when it’s a disgusting mess and no one wants to Netflix and chill with you.

So, here are some tips to stretching that Rick Ross money and make budgeting more bearable (and kick ass at it):

Make the act of doing your budget enjoyable.

Make the act of doing your budget enjoyable. I dread doing my budget but when I start, I get really into it and damn it feels good once I’m done. Scientific reason: our brain releases dopamine when we accomplish something. So do a budget, stick to it, and get high on your dopamine supply. Some of my students like to set a budgeting date with themselves every 2 weeks as they find it easier to manage their bi-weekly bills and income schedule that way.

For my own budgeting dates, a good restaurant and my notebook are my best friends. There’s

just something about using a pen and paper (and a glass of vino) that makes you feel more connected to the budget. I also feel like I look like Hemingway about to write a f$*king masterpiece.

There are a ton of free budget spreadsheets on Google btw.

Spend less than you make.

If you’re not doing this, hate to break it to you but your budget will fail. Unless you win the lottery, run into a leprechaun with a pot of gold, or have a sponsor (#tagyoursponsor), spending more than you make will result in borrowing off credit as that money has to come from somewhere. Just... don't.

Pay off your debts first.

Financial advisors always say pay yourself first but this doesn't apply to you if you’re rolling in debt. #sorrynotsorry When making your budget, take money from your income to pay back your interest AND a considerable amount of the principal owing on your debt. If you don’t trust yourself to pay off your re-advanceable credit card, get a personal loan like

MogoLiquid to pay it off.

A personal loan will get you on a payment schedule and won’t let you re-borrow the payment you just made an hour after the transaction cleared because you just had to have those shoes! A plan like this will have you out of debt in single digit years vs the double digits that it can take you to pay off a credit card debt.

Save for a sunny day.

Why do people say save for a rainy day? When it rains, I’m spending the least amount of money as my day consists of hibernating with Netflix and eating whatever I can find in my cupboard. So, I like to say “Save for a sunny day” because when the sun comes out, I want to do everything and be everywhere. Plus if you’re young, you have the gift

of time and compounding interest which could make for a much sunnier retirement.

Budgeting rule on savings: once you’ve made arrangements for your debts, pay yourself first by saving/investing about 10% of your income.

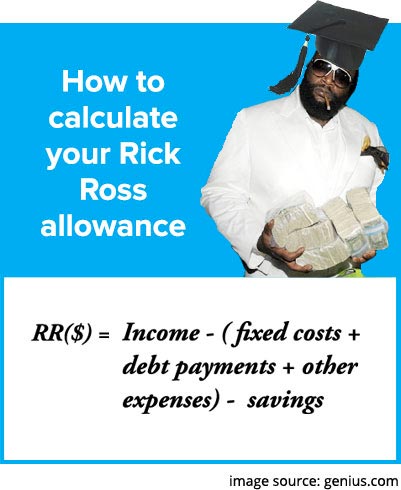

Give yourself some Rick Ross Money.

I call my budgeting method the Rick Ross Budget because Rick Ross knows how to Blow Money Fast and ironically, the success to budgeting is to give yourself a little money each month to BMF. It’s like dieting: if you eliminate carbs, sugar, gluten and fat all at once, I can pretty much guarantee that you’re going to cheat and have a full binge on anything that you can get your hands on. It’s the same with budgeting—your Rick Ross money will let you satisfy your guilt-free spending in a controlled way and take away the urges of overspending because you’re not putting excessive restraints on yourself.

I also separate my Rick Ross money from my other funds by loading it onto my MogoCard (coming soon), which gives you yet another level of spending control.

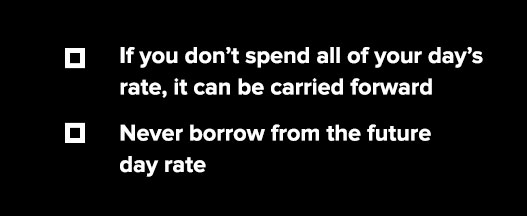

Set your day rate, playa.

A good way to stay in control and not overspend is to give yourself a day rate. This is outside of your fixed costs, debt payments, and savings. Take your food allowance and Rick Ross money and calculate how much of that can you spend per day. This rule really helped me stop overspending on food.

Here are some rules

Remember, budgeting takes work but the reward is worth it.

Chantel Chapman Chantel Chapman is Mogo’s Financial Fitness Coach. She teaches you how to be an adult, and is also the host of our Adulting 101 events. With over a decade’s experience as a mortgage broker, Chantel recognized a need for financial education with many of her first-time homebuyers, so she began creating custom content to help guide them. Chantel is the founder of Holler For Your Dollar, a consulting firm that jump-starts anyone who’s ready to dive into the world of Adulting or entrepreneurship. Her role at Mogo puts her skills to use creating and teaching digestible, yet educational financial literacy content geared to millennials and daring entrepreneurs.

Check your rate to get:

Got debt that’s getting in the way of your Rick Ross budget? Apply for the MogoLiquid loan and use it to consolidate your debt into one low payment!