Mogo Presents: Holler For Your Dollar’s 5 Steps to a Rocking Credit Score

Did you know that one of the sexiest holidays of the year happens today? It’s** “Get Smart About Credit Day”**! Excited yet? If not, get ready!

Mogo has arranged free access to Holler For Your Dollar’s “5 Steps to a Rocking Credit Score” video. Enjoy!

Mogo Presents: Holler For Your Dollar’s 5 Steps to a Rocking Credit Score.

*Guest writer: Chantel Chapman* If you thought report cards stopped after graduation- you are wrong. There is another little report card that follows us around into adulthood called the Credit Bureau. And on this credit bureau is your credit score. Your credit score is your financial reputation based on a scoring system. Much like life, if you have a good rep, you’ll be presented with more invites and opportunities. Think of it like this: If you’re late all the time and never answer you friends’ text messages, eventually people won’t want you around. Your credit reputation is the same — if you don’t pay your bills on time or incur more debt than you can handle, your credit score will drop (along with all future opportunities, making car leases/ mortgages/ rental properties increasingly harder to attain). The credit bureau reports the history of all of your previous debts, and then generates your personal score.5 Steps to a Rocking Credit Score

If your credit is a joke, it’ll be difficult to get your hands on a loan in the first place. Much like the reputation you earn in high school after a night of one too many Jell-O shots, your credit rep can be a source of shame that follows you for your entire life, if you lose control. That’s why we’re here to explain how to earn a credit rep that won’t make your lender blush when she has to gently turn you down for a loan.

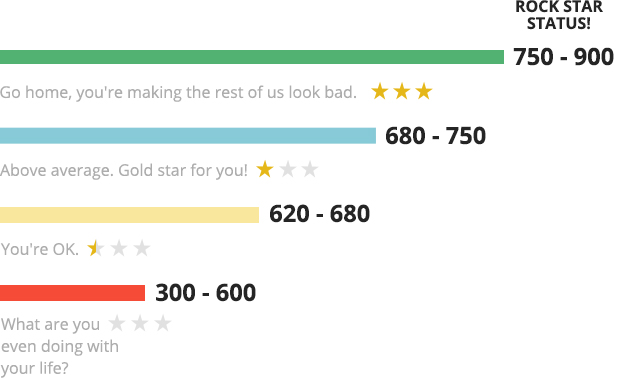

What does your score mean?

How does it affect your ability to obtain and use credit?

If you’ve earned yourself a rock star score, loans/credit cards/various forms of credit will be easily attainable, complete with the best interest rates. If your score is low, you may be asked to have a credit co-signer, or be rejected altogether.

Who checks your credit?

Any institution that lends money for any form of credit can check your credit. This includes, but is not limited to, car loans, credit cards, gas card, etc. You should also be aware that cell phone companies may pull your credit information in certain situations. It is becoming increasingly common for future employers to pull credit checks as well, as it’s a good indication of how responsible you are in life.

Here are the 5 Steps to Credit Score Success:

STEP 1

Don’t miss any minimum monthly payments. Whether your minimum payment is $4 or $400, it needs to be made on time — otherwise your credit score will plunge to depths you don’t even want to think about. We’re talking bowels of hell depths, here. So set an alarm, get your automatic payment on, whatever you need to do — just don’t miss your payment or you’re asking for a slow and painful credit death.

STEP 2

Never let your balance exceed 70% of the limit. For example, if your credit card has a balance of $1000, never let your balance go beyond $700. That way, you’ll have room for interest and service fees. Because you know there are fees, right? J. Lo’s love might come for free, but credit does not. Trust and believe.

***Rock star tip- if it’s a credit card- pay it off every month. Don’t spend more than you make! But, if you can't pay it off, try not to go over 35%.

STEP 3

Have at least two forms of active credit. Just when you thought you could build your credit with that one Bay card that’s been sitting in your wallet since 2003, we throw in this monkey-wrench: you should have at least two trade lines of credit open. The more responsibility you can handle, the better a credit candidate you’ll be. You credit trade lines should have a combined limit of at least $2000, to increase your credit worthiness.

STEP 4

Don’t have too many inquiries. In work, play, and credit, one truth remains: being promiscuous will earn you a bad reputation. In high school, a bad rap might force you to fight off a bunch of spikey-haired dudes who drown themselves in Axe Body Spray. In the world of credit, it’s worse — you won’t be able to rent a car when you’re on vacation. Or rent an apartment on your own. Or start your own business. Sucks to be you, either way.

STEP 5

Don’t let your accounts go to collections. When you start dodging debt like it’s a drunk dude with halitosis, your account will get sent to a third party in hopes that they’ll be able to recover the money you borrowed from the original lender. Whether you gave your number to some guy you never want to see again or you have a debt that you defaulted on, get ready for your phone to blow up with unknown numbers on the regular. And adding insult to injury, most lenders won’t give credit to anyone unless they’re collection-free.