Save $100 in 10 Min: Cut Your Banking Fees & Save Big Bucks

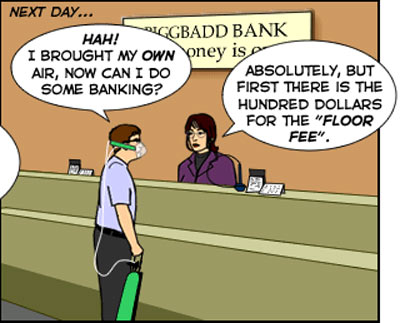

Saving money can be expensive! Your paycheck is automatically deposited into your account, months come and go – and many of us don’t keep close tabs on what it does while it’s in there. It’s probably been years since you established your bank account and agreed to the terms and conditions. Do you eagerly read all the updates and emails that your bank sends you? If you’re like most of us, probably not.

Here are some tips for spotting banking fees, getting them cut down, and getting the most out of them.

Check the records

Online banking is great for keeping track of your money – even when it’s been months since the transaction took place. Sort through your account debits to see which have been charged by your bank. With monthly fees ranging from $3 – $15.99 (or even more!), those expenses can really add up.

Get rid of them!

Now that you know how much you’re paying in banking fees, you know how much you want to get rid of. Call your bank to discuss the fees. There are plenty of free checking accounts out there, so to get your fees to $0, you might need to switch banks. For a difference of over $150/year, it could be worth the bank-changing process.

If you’re paying for it, get what you pay for!

If you can’t negotiate your fees away, be sure you’re taking advantage of what you’re paying for. Sometimes these fees give you access to in-person financial advice, reward points or even extra insurance. Know what you’re paying for, and make sure to take advantage.